By Steve Roth

“Printing money.” You hear it all the time in economics discussions — from economists in every phylum of the (rapidly) evolving field, from financial types, from reporters and everyday news consumers, and from politicians across the spectrum. For some participants, it’s the most bitter invective you can hurl; it explains the moral decline of nations, and the world. Even less…enthusiastic discussants attribute great economic power to the act.

But most references to money printing are just gestures toward something undefined: roughly, “pouring money into the private sector.” The presumption is that doing so has important economic effects — whether it’s governments issuing new physical currency, central banks issuing “reserves” (basically, bank money), banks issuing loans, whatever. But beyond that vague sense, there’s little agreement on what it means, precisely. You’ll often see the meaning shift (silently) in the middle of discussions, even in the middle of sentences. So 99% of discussions that employ the term are doomed to confused failure.

What in the heck does “money printing” mean? What should it mean? What are useful ways of talking about it, and hence thinking about it (together)?

Try starting, at least provisionally, with one bare assumption, a more precise definition of “pouring money”: money-printing adds assets to private-sector balance sheets. A king mints some tin coins, or a government prints bills, and they pay people and firms to produce goods and services — or they just give the money away. They’re adding to the asset side of private-sector balance sheets. Recipients have more money. Or: banks issue loans to people and businesses. Again: more assets on private-sector balance sheets. That’s pretty much the sine qua non of “money printing” — the thing that makes it what it is.

If it doesn’t add assets (pour money onto) private-sector balance sheets, it’s not money printing. Go with that for now.

(When money gets printed, it may also increase private-sector net worth — assets minus liabilities. But it might not. Hold that thought.)

Get Evonomics in your inbox

Now consider the various things that people refer to as money-printing. If you adopt the one assumption above, do they qualify for the name?

Printing Physical Money. Start with physical currency — coins and bills. Is printing money actually money-printing? In a rather idealized world, sure. The queen or the temple authorities mint a whole bunch of tin coins and use them to pay workers. (Actually more likely: soldiers.) The workers have more balance-sheet assets, created out of thin air.

Those coins (and likewise dollar bills) are just handy physical tokens provided by government, which make it easy to transfer assets from one person’s balance sheet to another.

But in the modern world where most assets are held in bank and brokerage accounts, it’s different. When a bank depositor withdraws cash, the bank just marks down their deposit balance by the same amount as the cash withdrawn. It’s just an asset swap: you have more dollar bills on your balance sheet, and less bank-deposit assets. The bank has less cash, and also less liability to pay out cash to you in the future. The amount of private-sector assets doesn’t change; only the portfolio mix changes.

If depositors want more cash for transactions and the bank is short on vault cash, it can ask the central bank for more. Just like a bank depositor, it receives cash, and the central bank marks down the bank’s deposit balance. Again, it’s just an asset swap, a portfolio shift. There’s no change to total private-sector assets.

If the central bank is short on vault cash because people are withdrawing it and stuffing it in mattresses, it can ask Treasury (the Mint and Bureau of Printing and Engraving) to print more. Is that money-printing, in the economically significant sense we’re talking about here? Not really. Because the central bank doesn’t use that new physical money to pay people, or give it away. It swaps it with banks, and banks swap it with depositors. Depositors’ bank balances (and banks’ associated liabilities) simply go down, vanish, and cash appears in depositors’ mattresses. The private-sector asset mix changes (and banks’ balance sheets shrink, equally on both sides), but total private-sector assets don’t. Just: the assets are in wallets and mattresses, instead of in banks.

So yeah, it’s nonintuitive but very real: in a modern financialized banking economy, money printing isn’t really money printing, in any economically significant sense. The U.S. Mint and the Bureau of Printing and Engraving have no influence on the economy. They simply provide convenient physical tokens for transferring assets between balance sheets. (Just for a sense of magnitude here: U.S. household assets total about $103 trillion. There’s $1.5 trillion of U.S. currency in circulation.)

But really: when economists talk about money printing, they’re rarely talking about printing physical currency. In what other senses do they use the term?

Quantitative Easing. You’ve heard a lot about this since the Great Whatever, and it’s often referred to as money printing. But is it really? It consists of the central bank buying bonds from the private sector, and issuing newly created “reserves” in return. (Think of those reserves, banks’ deposits at the central bank, as bank meta-money, that they only exchange among themselves.) It’s an asset swap with the private sector: reserves for bonds. The private sector ends up with a different portfolio mix: more reserves, less bonds. So while the central bank is issuing new reserves out of thin air, it’s retiring bonds from the private sector in equal amount. It’s little different from Treasury paying off and retiring bonds when they expire. But however you view that, the asset swaps themselves have no effect on the total stock of private-sector assets.

To be clear on the mechanics: to buy all those bonds, the central bank has to outbid the market. So QE, while it’s happening, must drive up bond prices, and (hence) drive down yields/interest rates. Which may cause investors to shift to riskier investments like stocks, driving up the equity market. So QE, while it’s being implemented, does have second- and third-order economic effects. But the act of QE itself — swapping reserves for bonds — adds nothing to private-sector asset balances. It may cause there to be more private-sector “money” (see Capital Gains, below), but it doesn’t “print,” issue, net new private-sector assets.

Government Deficit Spending. Now we’re getting somewhere. Recall the queen, king, or temple authority issuing new tin coins, and paying people to do things. Modern governments instead just deposit money in private-sector bank accounts. Same thing. If they issue more deposits than they tax back, the private sector has more assets. And significantly: the private sector doesn’t have any more liabilities as a result (except perhaps some imponderable future tax liability, unrecorded on their balance sheets), so they have more net worth. Government deficit spending creates new private-sector balance-sheet assets (and net worth) out of thin air. That sounds a whole lot like money printing.

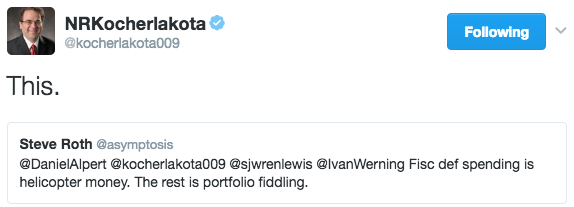

In a blatant appeal to authority, here from Narayana Kocherlakota, former president of the Federal Reserve Bank of Minneapolis:

Government Bonds. But wait: the government borrows to cover that deficit spending, right? It issues bonds equal to the deficit. Again: that’s just an asset swap. The private sector ends up with bonds on its balance sheet instead of checking-account balances — different portfolio mix (which may have carry-on economic effects). But bond issuance, government borrowing, results in zero net change to private-sector assets, and net worth. Same as QE.

At least in theory, the government could just skip the whole bond-issuance thing (though that would leave the Fed rather flummoxed in the mechanics of its mission). That “borrowing” requirement is self-imposed, inscribed in law; it’s not handed down from on high. Removing that requirement would have no direct accounting effect on total private-sector assets, only on the portfolio mix. (Imagine there’s no bondholders, and no government “debt”…)

Bank Lending. When you borrow money from your bank, they deposit money in your bank account. You (and the private sector) have more assets. The bank creates that money out of thin air; that’s what they’re chartered and licensed to do by the central bank. They’re essentially a central-bank franchisee. So in the economically significant sense bruited here, bank lending prints money. This is often called “inside money,” meaning that it’s created inside the private sector instead of externally — “outside money,” created by government deficit spending. (Once its created, it really doesn’t matter where it came from.)

Significantly, when banks issue loans they create both assets and liabilities on your balance sheet — you get the money, but you gotta pay them back. So while bank lending creates new assets, it doesn’t create net worth, as government deficit spending does.

Holding Gains. Nobody calls capital gains money printing. But they should. Holding gains do stand out by the assumption above: when the stock or real-estate market goes up, the private sector magically has more assets (but no more liabilities, so: more net worth). Nobody, and no sector, issues those new assets; they just appear. This asset-creation mechanism actually dwarfs the others.

This leads to a:

Gotcha. The eagle-eyed among you will have long ago spotted the definitional legerdemain here. We started this discussion with an assumption:

If it doesn’t increase private-sector assets, it’s not money printing.

But it does not necessarily follow that:

If it does increase private-sector assets, it is money printing.

This is of course a definitional choice, a decision about the most useful way to talk and think about money printing. (If we use the term at all; arguably it should be banned in favor of “balance-sheet asset creation” or similar.)

Monetarists in particular will object to this definition, pointing instead to various monetary aggregates of particular currency-like financial instruments — instruments whose market values, prices, are institutionally pegged to the unit of account (eg “the dollar”). Those instruments (almost) never “break the buck.” A runup in, say, the stock market has no direct accounting effect on those monetary aggregates, so it’s not money printing in monetarist-speak.

But all those monetary-aggregate discussions are just vague, hand-waving gestures toward some measure(s) that might represent a thing they call the “money supply” — a completely undefined and unquantifiable term which is only meaningful on dimensionless supply-and-demand diagrams. Most usages of that term don’t even make clear whether “supply” refers to some stock of money, or to flows of money.

The definition here at least has the virtue of being fixed, perfectly clear, and internally consistent and coherent in accounting terms. Money printing = creating new aggregate private-sector assets (and, perhaps, net worth). Measures of asset levels and changes are arguably much more useful descriptors and predictors of economic effects than the undefined or variously-defined “money supply.” Since the end of Bretton-Woods, for instance, a decline in real household assets (or net worth) has been a nearly perfect predictor of recessions.

Should we call those mechanisms that increase private-sector assets “money printing”? Only if we agree that it’s a useful way to talk about economies, think about them together, model them, and try to figure out how they work.

In the meantime, economists should be banned from using the term “money printing,” until they agree on some coherent (and measurable) meaning for the term.

2017 February 12

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!