By Tim O’Reilly

Modern economics likes to think of itself as a science, and too often its practitioners have attempted to uncover its “laws,” as if they were modern Isaac Newtons uncovering the laws of motion. But many of the laws of economics are far more like the rules of a game than like the laws of nature. Some of the rules represent what appear to be fundamental constraints – the availability of resources, say, or the absorptive capacity of the environment, or even the behavioral patterns of human nature – while others are arbitrary and subject to change, such as tax policy, government entitlements, and minimum wage requirements.

An economy has untold possible outcomes. Its complexity comes both from the near infinite variety that can come from permutations of simple rules, and from the fact that billions of humans are playing the game simultaneously, each affecting the outcomes for each other. Many of the rules are written down nowhere, controlled by no one, and constantly evolving. Individuals, businesses, and governments are all players, and none of them can know the full consequences of their decisions.

Get Evonomics in your inbox

Even the simplest and most definitive of the “rules” of an economy are far more complex to apply than they appear on paper. As an internet wag noted many years ago, “The difference between theory and practice is always greater in practice than it is in theory.” This difference between theory and practice is driven by complex interactions not only between rules but between multiple players with competing incentives.

This complexity came to mind last year in a conversation I had with Uber’s economists. I was arguing that just as Google’s search algorithm takes many factors into account in producing the “best” results, Uber’s algorithm would benefit if it took drivers’ wages, job satisfaction, and turnover into account, and not just passenger pickup time, which is its current fitness function. (Uber aims to have enough drivers on the road in a given location that the average pickup time is no more than three minutes.)

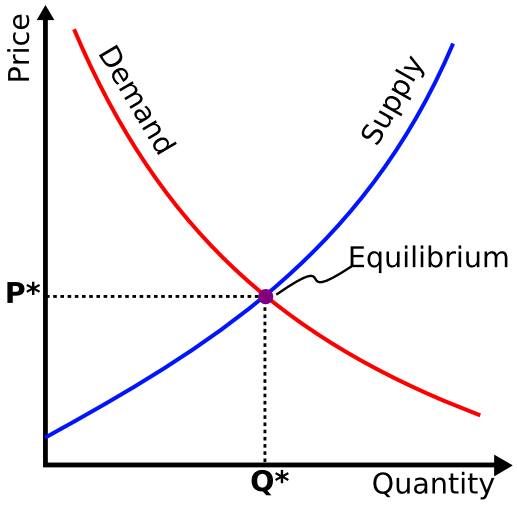

The economists explained to me that Uber’s wages were, by definition, optimal, because they simply represent a demand curve, one of the most basic laws of economics.

Uber’s real time matching algorithm actually satisfies two overlapping demand curves. If there are not enough passengers, the price must go down to stimulate passenger demand. That’s the essence of Uber’s frequent price cuts. But if there are not enough drivers to satisfy that demand, the price has to go up to encourage more drivers to come on the road. That’s the essence of surge pricing.

Uber’s argument is that the algorithmically determined cost of a ride is at the sweet spot that will drive the most passenger demand while also providing sufficient incentive to produce the number of drivers to meet that demand. And because driver income is the product of both the number of trips and the rate paid, that sweet spot will also maximize driver income. Any attempt to set rates to specifically raise driver income would suppress rider demand, and so reduce utilization and thus wages. Of course, if too many drivers show up, this will also reduce utilization, but the economists seem confident, based on data that they were not authorized to share with me, that they have generally found that sweet spot.

If Uber had the courage of its convictions, it would be doing completely algorithmic pricing (including surging prices in a negative direction, below the base price), much as Google sets ad prices with an auction. Why don’t they? Because they believe that customers are more comfortable with a known base price. That is, the difference between theory and practice is greater in practice than it is in theory.

I do believe that labor marketplace algorithms can be game changers for business and society if they are used to model and satisfy more and more complex conditions. There’s no question that even in their current state, Uber’s real time marketplace algorithms allows for far better matching of supply and demand than the previous structure of the taxicab and limousine industry. But Uber can do better. Algorithms such as these can be a real advance in the structure of our economy, but only if they take into account the needs of workers as well as those of consumers, businesses, and investors.

Here’s the rub in the real world: Uber isn’t just satisfying the two simultaneous demand curves of customer and driver needs, but also competitive business needs. Their desire to crush the incumbent taxi industry and to compete with rivals like Lyft also affect their pricing. Under the rules of the venture-backed startup game, they must grow at a rate that will allow them to utterly dominate the new industry that they have created in order to satisfy the enormous valuation placed on them by their investors.

Drivers are also not playing a simple game in which they can just go home if the wages aren’t sufficient. They have bills to pay, and may have to work far more hours than they would like in order to meet them. They may know in theory that they are depreciating the value of their vehicle and running up expenses that undermine their hourly earnings, but in practice they don’t feel they have any choice. Alternative jobs may be even worse, with less flexibility and even lower pay.

I suspect that over time, driver wages will need to increase at some rate that is independent of the simple supply and demand curves that characterize Uber’s algorithm today. Even if there are enough drivers, the quality of drivers deeply influences the customer experience.

Driver turnover is a key metric. As long as there are lots of people willing to try working for the service, it is possible to treat drivers as a disposable commodity. But this is short-term thinking. What you want are drivers who love the job and are good at it, are paid well, and as a result, keep at it. Over the long term, I predict that Uber and Lyft will be engaged in as fierce a contest to attract and keep drivers as they are to attract and keep customers today. And that competition may well provide further evidence that higher wages can pay for themselves by improving productivity and driving greater consumer satisfaction.

Many simplistic apologists for the capitalist system celebrate disruption and assume that while messy, it will all work out for the best if we just let “the invisible hand” do its work. This is true, if we correctly understand the invisible hand. The law of supply and demand is not describing some magical force, but the way that players of the game fight for competitive advantage. There are games within games. As Adam Smith put it,

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.”

The “law” emerges from the contest between players. As labor organizer David Rolf said to me, “God did not make being an auto worker a good job!” Those middle class jobs that we look back at with such nostalgia were the result of a fierce competition between companies and labor as to who would set the rules of the game. The invisible hand became very visible indeed by way of bitter strikes, and then transcended the market into the political process with the National Labor Relations Act of 1935 (the Wagner Act), the Labor Management Relations Act of 1947 (Taft-Hartley), and state “right to work laws.” Over the past 80 years, these acts have tilted the rules first one way, then the other. The low wage jobs of today aren’t inevitable, any more than were the high wage jobs of earlier decades.

Right now, we’re at an inflection point, where many rules are being profoundly rewritten. Much as happened during the industrial revolution, new technology is obsoleting whole classes of employment while making untold new wonders possible. It is making some people very rich, and others much poorer. It is giving companies new ways to organize; those new forms of organization are gradually being matched by labor.

I am confident that the invisible hand will do its work. But not without a lot of struggle. The political convulsions we’ve seen in the UK and now in the US are a testament to the difficulties we face if we let the invisible hand struggle through normal channels! We are heading into a very risky time.

These discussions are more than theoretical. Rising global inequality is triggering a political backlash that could lead to profound destabilization of both society and the economy. As my friend Bill Janeway wrote to me in an email, “The supposed laws of welfare economics assert that the optimal distribution of wealth is achieved when (1) no one can be made better off if done so by making someone worse off and (2) the winners compensate the losers. Unfortunately, the winners rarely do except as the result of political coercion.” That political coercion may be at hand.

Many discussions of our technological future assume that the fruits of productivity will be distributed to the benefit of all. And that is clearly not the case. Right now, the economic game is enormously fun for far too few players, and an increasingly miserable experience for many others!

Get Evonomics in your inbox

“Between the end of World War II and 1968, the minimum wage tracked average productivity growth fairly closely,” wrote economist John Schmitt. “Since 1968, however, productivity growth has far outpaced the minimum wage. If the minimum wage had continued to move with average productivity after 1968, it would have reached $21.72 per hour in 2012 — a rate well above the average production worker wage. If minimum-wage workers received only half of the productivity gains over the period, the federal minimum would be $15.34.”

Meanwhile, the vast bulk of the value created by increasing productivity has been allocated to corporate profits. Contrary to what you might expect, this is not because companies need those higher profits to grow and sustain themselves, investing in new products and hiring more people in the process. It is because of the unintended consequences of rules designed to align the interests of management and shareholders that instead made management prioritize growth of the stock price above all other considerations. As Rana Foroohar, author of the book Makers and Takers and one of the speakers at this year’s Next:Economy Summit, put it in a recent Time magazine cover story, “the single biggest unexplored reason for long-term slower growth is that the financial system has stopped serving the real economy and now serves mainly itself.”

Another huge swath of value has been allocated to consumer surplus – the difference between what goods sell for and what customers might have been willing to pay. (A huge amount of the value that new technology brings has been provided to consumers free of charge, creating consumer surplus that is difficult to measure.) Free trade and depressed wages have also led to fierce competition by companies to expand their market share by offering goods at lower prices (much as Uber has done with taxi fares.) This is also a powerful kind of consumer surplus, and one of many strategies that economic game players employ to gain advantage.

I like to use Walmart as an example of the complexity of the game play and the tradeoffs that players ask us to make as a society. Walmart has built an enormously productive business that has vastly reduced the cost of the goods that it supplies. A large part of the value goes to consumers in the form of lower prices. Another large part goes to corporate profits, which benefits both company management and outside shareholders. But meanwhile, Walmart workers are paid so little that most need government assistance to live — by coincidence, the difference between Walmart wages and a $15 minimum wage for their US workers (approximately $5 billion/year) is not that far off from the $6 billion/year that Walmart workers are subsidized via Federal supplemental nutrition assistance (SNAP, formerly known as “food stamps.”)

You can see here that there is a five-player game in which gains (or losses) can be allocated in different proportion to consumers, the company itself, financial markets, workers, or taxpayers. The current rules of our economy have encouraged the allocation of gains to consumers and financial shareholders (now including top company management), and the losses to workers and taxpayers. But it doesn’t have to be that way.

We can wait for the invisible hand (i.e. the push and pull of the many players in the game) to work things out, or we can try out different strategies for getting to optimal outcomes more quickly. We can rewrite the rules.

In professional sports, leagues concerned about competitive play often establish new rules. Football (soccer) has changed its rules many times over the past 150 years. NBA basketball added the 3-point shot in 1979 to make the game more dynamic; rule changes are being proposed again after the game-changing play of Golden State Warriors star Stephen Curry. Many sports use salary caps to keep teams in large markets from buying up the best talent and making it impossible for smaller markets to compete. And so on.

The “fight for 15”, the movement towards a national $15 minimum wage, is one way to rewrite the rules. Businesses and free market fundamentalists argue that raising minimum wages will simply cause businesses to eliminate jobs, making workers even worse off. The evidence shows that this isn’t the case. As Nick Hanauer said during the Q&A at last year’s Next:Economy Summit, “That’s an intimidation tactic masquerading as an economic theory.”

The key question, expressed in the true language of Adam Smith’s “invisible hand,” is who gets more, and who gets less. Capital, labor, consumers, taxpayers.

As noted above, a $15 minimum wage might cost Walmart on the order of $5 billion/year. This is no small number. It represents about a quarter of Walmart’s annual profits, and about 1.25% of its annual US revenues. But it might save taxpayers $6 billion per year (and that’s just the amount used to subsidize Walmart; including all the other low-wage employers in America, the number is far larger.)

If Walmart weren’t able to pass off part of its true costs onto taxpayers, the company would have to accept lower profits or raise its prices. But is that really such a bad thing? Let’s do some back of the napkin math. If Walmart’s profits were reduced by $5 billion (approximately 20%), its market cap might fall, a loss to shareholders. But leaving aside the shock of a sudden drop in earnings due to a change in the rules, would the owners of Walmart really not have wanted to own it if it generated $20 billion a year in profit instead of $25 billion?

If Walmart were to pass along the additional costs to consumers, prices would have to go up by 1.25% (or $1.25 for every $100 spent at Walmart.) If the costs were split between capital and consumers, that would require only a 10% drop in Walmart profits and an additional 62 cents per $100 spent by consumers. Would people really stop shopping at Walmart if they had to spend little more than an additional half cent for every dollar?

Those higher prices might discourage some customers, but the higher incomes of workers might encourage them to spend more. So it’s not inconceivable that Walmart and its shareholders would come out whole.

And of course, raising the minimum wage is only one way to address the way that the current rules of our economy favor owners of capital over human workers. Tax rates really do need some rethinking! Why do we have preferential rates for taxes on capital when it is so abundant that much of it is sitting on the sidelines rather than at work in our economy? Why do we tax labor income when one of the problems in our economy is lack of aggregate demand due to insufficient consumer spending?

We could change these relative tax rates, and even institute a “Wealth tax” such as proposed by Thomas Piketty and use the proceeds to help fund a Universal Basic Income! In fact, why not tax carbon rather than labor, substituting a carbon tax for social security taxes, among the most regressive of all taxes imposed? These rule changes might be even more costly to some capital owners but might well benefit society overall!

These are political decisions as much as they are purely economic or business decisions. And that is appropriate. Economic policy shapes the future not just for one person or one company, but for all of us.

Throughout history and across continents, economies have played the game using different rules: All land belongs to kings and aristocrats. No one can own the land. All property should be held in common. Property should be private. Property is entailed and cannot be sold by the owners or heirs. Labor belongs to kings and aristocrats and must be supplied on demand. A man’s labor is his own. Women belong to men. Women are independent economic actors. Children are a great source of cheap labor. Child labor is a violation of human rights. Humans can be the property of other humans. No human can be enslaved by another.

We look back at some of these rules as barbaric, and others as utopian dreams. But we also can see that some rules have led to golden periods when society flourished.

Here is one of the failed rules of today’s economy: humans are expendable. Their labor should be eliminated as a cost whenever possible. This will increase the profits of a business, and richly reward investors. These profits will trickle down to the rest of society.

The evidence is in. This rule doesn’t work.

It’s time to rewrite the rules. We need to play the game of business as if people matter.

Originally published here.

2016 August 4

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!