By Tim O’Reilly

At one point early this year, Elon Musk briefly became the richest person in the world. After a 750% increase in Tesla’s stock market value added over $180 billion to his fortune, he briefly had a net worth of over $200 billion. It’s now back down to “only” $155 billion.

Understanding how our economy produced a result like this—what is good about it and what is dangerous—is crucial to any effort to address the wild inequality that threatens to tear our society apart.

The betting economy versus the operating economy

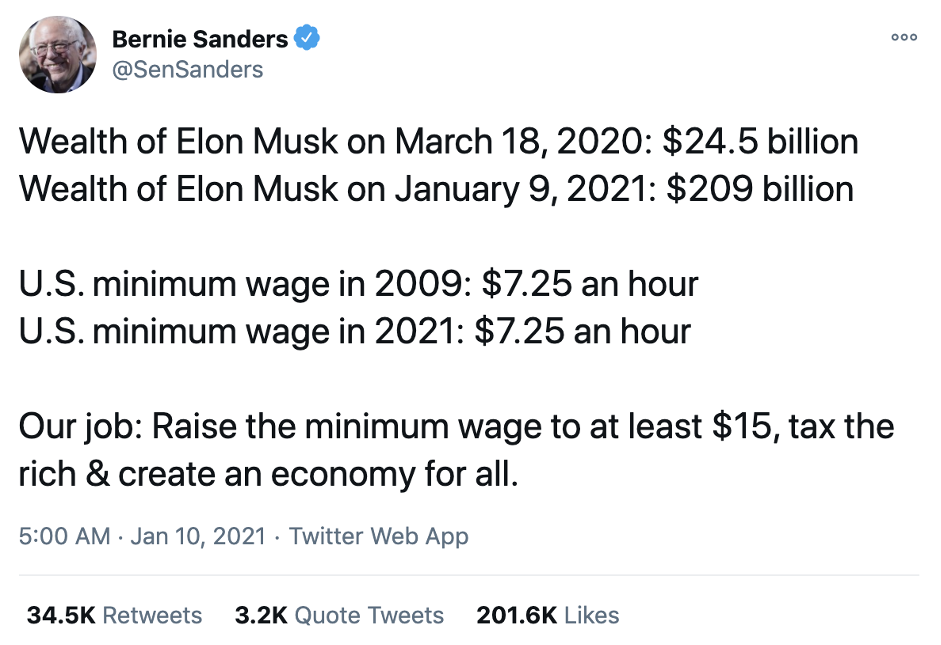

In response to the news of Musk’s surging fortune, Bernie Sanders tweeted:

Bernie was right that a $7.25 minimum wage is an outrage to human decency. If the minimum wage had kept up with increases in productivity since 1979, it would be over $24 by now, putting a two-worker family into the middle class. But Bernie was wrong to imply that Musk’s wealth increase was at the expense of Tesla’s workers. The median Tesla worker makes considerably more than the median American worker.

Elon Musk’s wealth doesn’t come from him hoarding Tesla’s extractive profits, like a robber baron of old. For most of its existence, Tesla had no profits at all. It became profitable only last year. But even in 2020, Tesla’s profits of $721 million on $31.5 billion in revenue were small—only slightly more than 2% of sales, a bit less than those of the average grocery chain, the least profitable major industry segment in America.

No, Musk won the lottery, or more precisely, the stock market beauty contest. In theory, the price of a stock reflects a company’s value as an ongoing source of profit and cash flow. In practice, it is subject to wild booms and busts that are unrelated to the underlying economics of the businesses that shares of stock are meant to represent.

Why is Musk so rich? The answer tells us something profound about our economy: he is wealthy because people are betting on him. But unlike a bet in a lottery or at a racetrack, in the vast betting economy of the stock market, people can cash out their winnings before the race has ended.

This is one of the biggest unacknowledged drivers of inequality in America, the reason why one segment of our society prospered so much during the pandemic while the other languished.

What are the odds?

If the stock market is like a horse race where people can cash out their bets while the race is still being run, what does it mean for the race to finish? For an entrepreneur or an early-stage investor, an IPO is a kind of finish, the point where they can sell previously illiquid shares on to others. An acquisition or a shutdown, either of which puts an end to a company’s independent existence, is another kind of ending. But it is also useful to think of the end of the race as the point in time at which the stream of company profits will have repaid the investment.

Since ownership of public companies is spread across tens of thousands of people and institutions, it’s easier to understand this point by imagining a small private company with one owner, say, a home construction business or a storage facility or a car wash. If it cost $1 million to buy the business, and it delivered $100,000 of profit a year, the investment would be repaid in 10 years. If it delivered $50,000 in profit, it would take 20. And of course, those future earnings would need to be discounted at some rate, since a dollar received 20 years from now is not worth as much as a dollar received today. This same approach works, in theory, for large public companies. Each share is a claim on a fractional share of the company’s future profits and the present value that people put on that profit stream.

This is, of course, a radical oversimplification. There are many more sophisticated ways to value companies, their assets, and their prospects for future streams of profits. But what I’ve described above is one of the oldest, the easiest to understand, and the most clarifying. It is called the price/earnings ratio, or simply the P/E ratio. It’s the ratio between the price of a single share of stock and the company’s earnings per share (its profits divided by the number of shares outstanding.) What the P/E ratio gives, in effect, is a measure of how many years of current profits it would take to pay back the investment.

The rate of growth also plays a role in a company’s valuation. For example, imagine a business with $100 million in revenue with a 10% profit margin, earning $10 million a year. How much it is worth to own that asset depends how fast it is growing and what stage of its lifecycle it is in when you bought it. If you were lucky enough to own that business when it had only $1 million in revenue and, say, $50,000 in profits, you would now be earning 200x as much as you were when you made your original investment. If a company grows to hundreds of billions in revenue and tens of billions in profits, as Apple, Microsoft, Facebook, and Google have done, even a small investment early on that is held for the long haul can make its lucky owner into a billionaire. Tesla might be one of these companies, but if so, the opportunity to buy its future is long past because it is already so highly valued. The P/E ratio helps you to understand the magnitude of the bet you are making at today’s prices.

The average P/E ratio of the S&P 500 has varied over time as “the market” (the aggregate opinion of all investors) goes from bullish about the future to bearish, either about specific stocks or about the market as a whole. Over the past 70 years, the ratio has ranged from a low of 7.22 in 1950 to almost 45 today. (A note of warning: it was only 17 on the eve of the Great Depression.)

What today’s P/E ratio of 44.8 means that, on average, the 500 companies that make up the S&P 500 are valued at about 45 years’ worth of present earnings. Most companies in the index are worth less, and some far more. In today’s overheated market, it is often the case that the more certain the outcome the less valuable a company is considered to be. For example, despite their enormous profits and huge cash hoards, Apple, Google, and Facebook have ratios much lower than you might expect: about 30 for Apple, 34 for Google, and 28 for Facebook. Tesla at the moment of Elon Musk’s peak wealth? 1,396.

Let that sink in. You’d have had to wait almost 1,400 years to get your money back if you’d bought Tesla stock this past January and simply relied on taking home a share of its profits. Tesla’s more recent quarterly earnings are a bit higher, and its stock price quite a bit lower, so now you’d only have to wait about 600 years.

Of course, it’s certainly possible that Tesla will so dominate the auto industry and related energy opportunities that its revenues could grow from its current $28 billion to hundreds of billions with a proportional increase in profits. But as Rob Arnott, Lillian Wu, and Bradford Cornell point out in their analysis “Big Market Delusion: Electric Vehicles,” electric vehicle companies are already valued at roughly the same amount as the entire rest of the auto industry despite their small revenues and profits and despite the likelihood of more, rather than less, competition in future. Barring some revolution in the fundamental economics of the business, current investors are likely paying now for the equivalent of hundreds of years of future profits.

So why do investors do this? Simply put: because they believe that they will be able to sell this stock to someone else at an even higher price. In times where betting predominates in financial markets, what a company is actually worth by any intrinsic measure seems to have no more meaning than the actual value of tulips during the 17th century Dutch “tulip mania.” As the history of such moments teaches, eventually the bubble does pop.

This betting economy, within reason, is a good thing. Speculative investment in the future gives us new products and services, new drugs, new foods, more efficiency and productivity, and a rising standard of living. Tesla has kickstarted a new gold rush in renewable energy, and given the climate crisis, that is vitally important. A betting fever can be a useful collective fiction, like money itself (the value ascribed to pieces of paper issued by governments) or the wild enthusiasm that led to the buildout of railroads, steel mills, or the internet. As economist Carlota Perez has noted, bubbles are a natural part of the cycle by which revolutionary new technologies are adopted.

Sometimes, though, the betting system goes off the rails. Tesla’s payback may take centuries, but it is the forerunner of a necessary industrial transformation. But what about the payback on companies such as WeWork? How about Clubhouse? Silicon Valley is awash in companies that have persuaded investors to value them at billions despite no profits, no working business model, and no pathway to profitability. Their destiny, like WeWork’s or Katerra’s, is to go bankrupt.

John Maynard Keynes, the economist whose idea that it was essential to invest in the demand side of the economy and not just the supply side helped bring the world out of the Great Depression, wrote in his General Theory of Employment, Interest and Money, “Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

In recent decades, we have seen the entire economy lurch from one whirlpool of speculation to another. And as at the gambling table, each lurch represents a tremendous transfer of wealth from the losers to the winners. The dot-com bust. The subprime mortgage meltdown. Today’s Silicon Valley “unicorn” bubble. The failures to deliver on their promises by WeWork, Katerra, and their like are just the start of yet another bubble popping.

Why this matters

Those at the gaming table can, for the most part, afford to lose. They are disproportionately wealthy. Nearly 52% of stock market value is held by the top 1% of Americans, with another 35% of total market value held by the next 9%. The bottom 50% hold only 0.7% of stock market wealth.

Bubbles, though, are only an extreme example of a set of dynamics that shape our economy far more widely than we commonly understand. The leverage provided by the betting economy drives us inevitably toward a monoculture of big companies. The local bookstore trying to compete with Amazon, the local cab company competing with Uber, the neighborhood dry cleaner, shopkeeper, accountant, fitness studio owner, or any other local, privately held business gets exactly $1 for every dollar of profit it earns. Meanwhile, a dollar of Tesla profit turns into $600 of stock market value; a dollar of Amazon profit turns into $67 of stock market value; a dollar of Google profit turns into $34, and so on. A company and its owners can extract massive amounts of value despite having no profits—value that can be withdrawn by those who own shares—essentially getting something for nothing.

And that, it turns out, is also one underappreciated reason why in the modern economy, the rich get richer and the poor get poorer. Rich and poor are actually living in two different economies, which operate by different rules. Most ordinary people live in a world where a dollar is a dollar. Most rich people live in a world of what financial pundit Jerry Goodman, writing under the pseudonym Adam Smith, called “supermoney,” where assets have been “financialized” (that is, able to participate in the betting economy) and are valued today as if they were already delivering the decades worth of future earnings that are reflected in their stock price.

Whether you are an hourly worker or a small business owner, you live in the dollar economy. If you’re a Wall Street investor, an executive at a public company compensated with stock grants or options, a venture capitalist, or an entrepreneur lucky enough to win, place, or show in the financial market horse race, you live in the supermoney economy. You get a huge interest-free loan from the future.

Elon Musk has built not one but two world-changing companies (Tesla and SpaceX.) He clearly deserves to be wealthy. As does Jeff Bezos, who quickly regained his title as the world’s wealthiest person. Bill Gates, Steve Jobs, Larry Page and Sergey Brin, Mark Zuckerberg, and many other billionaires changed our world and have been paid handsomely for it.

But how much is too much? When Bernie Sanders said that billionaires shouldn’t exist, Mark Zuckerberg agreed, saying, “On some level, no one deserves to have that much money.” He added, “I think if you do something that’s good, you get rewarded. But I do think some of the wealth that can be accumulated is unreasonable.” Silicon Valley was founded by individuals for whom hundreds of millions provided plenty of incentive! The notion that entrepreneurs will stop innovating if they aren’t rewarded with billions is a pernicious fantasy.

Get Evonomics in your inbox

What to do about it

Taxing the rich and redistributing the proceeds might seem like it would solve the problem. After all, during the 1950s, ’60s, and ’70s, progressive income tax rates as high as 90% did a good job of redistributing wealth and creating a broad-based middle class. But we also need to put a brake on the betting economy that is creating so much phantom wealth by essentially letting one segment of society borrow from the future while another is stuck in an increasingly impoverished present.

Until we recognize the systemic role that supermoney plays in our economy, we will never make much of a dent in inequality. Simply raising taxes is a bit like sending out firefighters with hoses spraying water while another team is spraying gasoline.

The problem is that government policy is biased in favor of supermoney. The mandate for central bankers around the world is to keep growth rates up without triggering inflation. Since the 2009 financial crisis, they have tried to do this by “quantitative easing,” that is, flooding the world with money created out of nothing. This has kept interest rates low, which in theory should have sparked investment in the operating economy, funding jobs, factories, and infrastructure. But far too much of it went instead to the betting economy.

Stock markets have become so central to our imagined view of how the economy is doing that keeping stock prices going up even when companies are overvalued has become a central political talking point. Any government official whose policies cause the stock market to go down is considered to have failed. This leads to poor public policy as well as poor investment decisions by companies and individuals.

As Steven Pearlstein, Washington Post columnist and author of the book Moral Capitalism, put it in a 2020 column:

When the markets are buoyant, Fed officials claim that central bankers should never second-guess markets by declaring that there are financial bubbles that might need to be deflated. Markets on their own, they assure, will correct whatever excesses may develop.

But when bubbles burst or markets spiral downward, the Fed suddenly comes around to the idea that markets aren’t so rational and self-correcting and that it is the Fed’s job to second-guess them by lending copiously when nobody else will.

In essence, the Fed has adopted a strategy that works like a one-way ratchet, providing a floor for stock and bond prices but never a ceiling.

That’s the fire hose spraying gasoline. To turn it off, central banks should:

- Raise interest rates, modestly at first, and more aggressively over time. Yes, this would quite possibly puncture the stock market bubble, but that could well be a good thing. If people can no longer make fortunes simply by betting that stocks will go up and instead have to make more reasonable assessments of the underlying value of their investments, the market will become better at allocating capital.

- Alternatively, accept much larger increases in inflation. As Thomas Piketty explained in Capital in the Twenty-First Century, inflation is one of the prime forces that decreases inequality, reducing the value of existing assets and more importantly for the poor, reducing the value of debt and the payments paid to service it.

- Target small business creation, hiring, and profitability in the operating economy rather than phantom valuation increases for stocks.

Tax policy also fans the fire. Taxes shape the economy in much the same way as Facebook’s algorithms shape its news feed. The debate about whether taxes as a whole should be higher or lower completely lacks nuance and so misses the point, especially in the US, where elites use their financial and political power to get favored treatment. Here are some ideas:

- Tax winnings from the betting economy at a higher rate than investment in the operating economy. Today’s system of capital gains taxes treats innovator Steve Jobs and hedge fund magnate Carl Icahn the same way. One of these people created enormous value. The other simply extracted it. When Jobs died in 2011 after decades of creating world-changing products and putting millions of people to work around the world, his stake in Apple was worth about $2 billion. In 2013, Icahn “invested” $3.6 billion in Apple stock and earned about $2 billion when he sold it in 2016. Apple didn’t need Icahn’s money—or that of any other investor. It was awash in cash. Nor did Icahn’s supposed investment help Apple to create anything of value. Icahn simply used his stake to pressure the company to do share buybacks, a technique that is used to drive up the share price and so “return cash to shareholders.” This kind of financial gamesmanship could be subject to a Pigovian tax—that is, a tax explicitly designed to discourage it.

- As President Biden has recently proposed, we could tax capital gains at the same rate as we tax so-called “ordinary income”—that is, income from labor. Labor income not only has a much higher graduated rate, it also bears payroll taxes for social security and unemployment insurance. This is why, as multibillionaire investor Warren Buffett pointed out, he pays a lower tax rate than the people working in his office.

- Provide full charitable deductions only to those who, like MacKenzie Scott, actually give their money away. Provide a much lower (or even nonexistent) deduction for putting money into an institution controlled by the donor, such as a private foundation or donor-advised fund that then doles out a tiny fraction each year so as to preserve another form of generational wealth.

- Fund the IRS properly, and target enforcement not against the poorest but against those most likely to be using aggressive tax avoidance techniques. According to the IRS commissioner, the US loses $1 trillion a year to “tax cheats,” most of them the ultrawealthy. Fortunately, there is some movement in this direction.

- Stop the practice outlined in a recent ProPublica report by which the ultrarich fund their lifestyles tax free by borrowing against their appreciating supermoney assets rather than paying themselves any taxable income. We have a progressive tax rate for a reason, and when the ultrarich pay a fraction of the stated rate due to loopholes like this, we make a mockery of the system.

In general, we should treat not just illegal evasion but tax loopholes the way software companies treat zero-day exploits, as something to be fixed as soon as they are recognized, not years or decades later. Even better, stop building them into the system in the first place! Most loopholes are backdoors installed knowingly by our representatives on behalf of their benefactors.

This last idea is perhaps the most radical. The tax system could and should become more dynamic rather than more predictable. Imagine if Facebook or Google were to tell us that they couldn’t change their algorithms to address misinformation or spam without upsetting their market and so had to leave abuses in place for decades in the interest of maintaining stability—we’d think they were shirking their duty. So too our policy makers. It’s high time we all recognize the market-shaping role of tax and monetary policy. If we can hold Facebook’s algorithms to account, why can’t we do the same for our government?

Our society and markets are getting the results the algorithm was designed for. Are they the results we actually want?

Originally published at O’Reilly Media

5 August, 2020

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!