By Steve Roth

You often hear calls out there — mostly from Right economists but also from some on the Left — for a consumption tax in the U.S. As presented, it’s a super-simple idea: tally your income, subtract your saving, and what’s left is your consumption. You pay taxes on that.

We want to encourage thrifty saving and discourage profligate consumption, so what’s not to like?

Lots. Before getting into the idea’s economic virtues and vices, consider the accounting. Whaddaya mean by “saving”? Economists are deeply confused about that word, so it’s worth sorting through a bit.

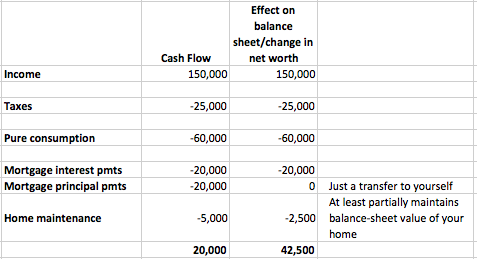

Start with a simple pared-down household. The only accounting complication is that they own a house:

How much did this household “save”? Should the interest payments count as consumption? The principal payments almost certainly should not (and could be treated that way under the rules of a consumption tax without a whole lot of work for homeowners and lenders…). But what about home maintenance? A new paint job increases your home’s asset value. Should you depreciate that asset value over some years? Or say you buy new appliances for your kitchen: You’re cash out of pocket, but your home is worth more. Are those purchases “consumption”?

This notion of some simple tally of your “saving” starts to look more complicated. We’re not talking “taxes on a 3-by-5 card” here. And this is not a complex household. There will have to be some complicated IRS rules for what counts as saving. (I won’t even touch here on various clever opportunities to game this system.)

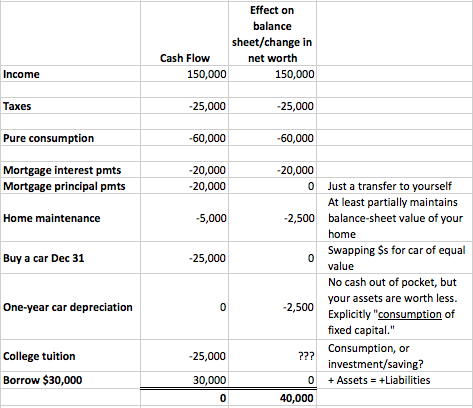

An expanded tally raises some other tricky questions:

What if this family leases its car with an option to buy at the end of the lease, instead of buying? How do you account for that? And this doesn’t even touch the troublesome issue of health care: is it consumption? That’s how it’s tallied in the national accounts. But if Americans didn’t invest in maintaining their health, how prosperous would our country be? Should we tax health spending? If you get sick, your taxes go up. Hmmm.

I’ll leave it to my gentle readers to consider the details — what’s consumption, what’s saving, and what’s neither? Just to say: I can’t quite see how this family would do their taxes without a complete balance-sheet accounting every year, or some quite complicated rules for 1040 filing that result in essentially the same thing.

The rather childishly simplistic “just tally your income and subtract your saving” isn’t so simple when you think about the actual details.

The tuition line raises a particularly vexing question, and brings us back to the second question: what economic effects would we see from a consumption tax, under various accounting and taxation rules? Clearly, if you tax tuition, you discourage education. And consider more-prosperous families paying for private school. Are those families “consuming” more education than public-school families? Those households would be especially hard hit if tuition counts as taxable consumption — as would those private schools. Is that A Good Thing?

Much more broadly, though, the notion that saving is good and consumption is bad rests on some completely incoherent economic notions. For individual households and firms, sure: saving is prudential, and savings funds (at least some of) their investment. But that’s simply not true collectively. Individual saving, spending less than your income, has no effect on our collective wealth (that mythical stock of “loanable funds”). It just means you’re holding the assets in your account instead of somebody else holding them (if you spend instead of saving).

Get Evonomics in your inbox

So the theory of collectively virtuous household-saving-funding-investment doesn’t make sense. And the empirics over many decades bear that out: higher saving rates have pretty much nothing to do with investment rates.

When you tax consumption, you discourage consumption, including some forms of so-called “consumption” —tuition, home maintenance, health maintenance — that arguably should be tallied as investment, at least in part. (In the national accounts, they aren’t, at all; they’re all consumption.)

And that raises a key question that cuts to the crux of economic thinking: why do producers produce stuff?

Any entrepreneur will give you a simple answer: they produce stuff because people are buying it, and consuming it (either immediately or over time). So taxing hence discouraging consumption discourages production — of both short-term consumption and long-term investment goods. A consumption tax, compared to, say, a wealth tax or a land-value tax, is a direct assault on GDP and GDP growth.

Is that what Right economists had in mind?

2017 August 5

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!