By Steve Roth

Households save money and lend it to businesses, who invest it in productive enterprises. That’s the economic story you’ve been hearing your whole life, right? Or at least since Econ 101. Saving funds investment. That core idea is embedded (and unquestioned) in modern macro: the Solow growth model, IS/LM, the lot.

Put aside that the basic bookkeeping of this idea — that personal saving creates “savings” that “fund” lending and investment — doesn’t make any sense. (It’s an error of composition; you have more savings if you save, but the economy doesn’t.) Let’s look at history: when households save more, is there more lending and (business) investment — either immediately or a few quarters/years down the road?

Get Evonomics in your inbox

Mostly: no.

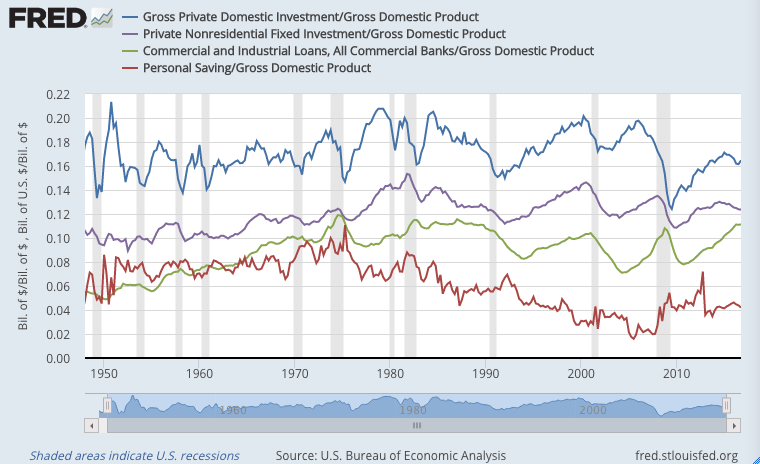

Here are some saving, lending, and investment measures for the U.S., post-war (starting Q1 1948), all divided by GDP to make them comparable:

The first thing to notice here: both lending and investment are vastly larger than household saving. They can’t be “funded” by that saving, or at least not much. (Think: bank lending and endogenous money.)

Otherwise, eyeballing this, it’s pretty much impossible to tell if these measures are correlated. When saving goes up or down, do lending and investment do likewise (concurrently, or some time later)? They’re all over the place. So let’s use software to look at correlations between them.

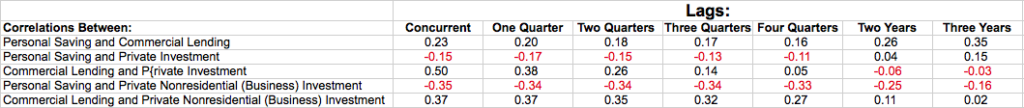

A correlation of 1.0 means the two measures move perfectly together — if X goes up, so does Y, by an equal amount. A correlation of -1 means they move perfectly in opposite directions — if X goes up, Y always goes down by an equal amount.

Of course, correlation doesn’t demonstrate causation. But lack of correlation, and especially negative correlation, does much to disprove causation. What kind of disproofs do we see here?

• Personal saving and commercial lending seem to be lightly correlated. The correlation declines over the course of a year, but then increases two or three years out. It’s an odd pattern, with a lot of possible causal stories that might explain it.

• Personal saving and private investment (including both residential and business investment) are very weakly correlated, and what correlation there is is mostly negative. More saving correlates with less investment.

• Commercial lending has medium-strong correlation with private investment in the short term, declining rapidly over time. This is not terribly surprising. But it has nothing to do with private saving.

• Perhaps the most telling result here: Personal saving has a significant and quite consistent negative correlation with business investment. Again: more saving, less investment. This directly contradicts what you learned in Econ 101.

• The last line — commercial lending versus business investment — is most interesting compared to line 3 (CommLending vs PrivInv). Changes in commercial lending seem to have their strongest short-term effects on residential investment, not business investment. But its effect on business investment seems more consistent and longer-term.

I’ll leave my gentle readers to ponder those only-somewhat stylized facts. Here’s the spreadsheet for any who want to explore further.

2017 January 30

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!