By Peter Barnes

THE LONDON UNDERGROUND abounds with warnings to “mind the gap,” referring to the space between station platforms and train doors. In our larger society similar warnings could be issued for the gaps between rich and poor and between humans and nature. These gaps must not only be minded, they must also be narrowed. The persistent question is how to do this, and I contend that a form of rent may be the best possible tool. But before we get to that, we must first become familiar with rent.

The term was first used by classical economists, including Adam Smith, to describe money paid to landowners. It was one of three income streams in the early years of capitalism, the others being wages paid to labor and interest paid to capital.

In Smith’s view, landlords benefited from land’s unique ability to enrich its owners “independent of any plan or project of their own.” This ability arises from the fact that the supply of good land is limited, while the demand for it steadily rises. The effect of landowners’ collection of rent, he concluded, isn’t to increase society’s wealth but to take money away from labor and capital. In other words, land rent is an extractor of wealth rather than a contributor to it.

Get Evonomics in your inbox

A century later, a widely-read American economist named Henry George (his magnum opus, Progress and Poverty, sold over two million copies) enlarged Smith’s insight substantially. At a time when Karl Marx was blaming capitalists for expropriating surplus value from workers, George blamed landlords for expropriating rent from everyone. Such rent extraction operated like “an immense wedge being forced, not underneath society, but through society. Those who are above the point of separation are elevated, but those who are below are crushed down.” George’s proposed remedy was a steep tax on land that would recapture for society most of landowners’ parasitic gains.

More recently, the concept of rent was expanded to include monopoly profits, the extra income a company reaps by quashing competition and raising prices. Smith had written about this form of wealth extraction too, though he didn’t call it rent. “The interest of any particular branch of trade or manufactures is always to widen the market and to narrow the competition…To widen the market may frequently be agreeable enough to the interest of the public; but to narrow the competition must always be against it, and can only serve to enable the dealers, by raising their profits above what they naturally would be, to levy, for their own benefit, an absurd tax upon the rest of their fellow-citizens.”

It’s important to recognize that the tax Smith spoke of isn’t the kind we pay to government; rather, it’s the kind we pay, much less visibly, to businesses with power. That’s because prices in capitalism are driven by four factors: supply, demand, market power and political power. The first two, which are omnipresent in economics texts, determine what might be called fair market value; the last two, which are prevalent in the real world, determine rent. Actual prices charged are the sum of fair market value and rent. Another way to say this is that rent is the extra money people pay above what they’d pay in truly competitive markets.

More recently, the term has been further extended to include income from privileges granted by government—import quotas, mining rights, subsidies, tax loopholes and so on. Many economists use the term “rent-seeking” to describe the multiple ways special interests use government to enrich themselves at the expense of others. If you’re wondering why Washington, D.C. and its environs have grown so prosperous in recent decades, it’s not because government itself has become gargantuan, it’s because rent-seeking has.

In short, traditional rent is income received not because of anything a person or business produces, but because of rights or power a person or business possesses. It consists of takings from the larger whole rather than additions to it. It redistributes wealth within an economy but doesn’t add any. As British economist John Kay put it in the Financial Times, “When the appropriation of the wealth of others is illegal, it’s called theft or fraud. When it’s legal, it’s called rent.”

BECAUSE RENT ISN’T LISTED separately on any price tag or corporate income statement, we don’t know exactly how much of it there is, but it’s likely there’s quite a lot. Consider, for example, health care in America, about one-sixth of our economy. There are many reasons the U.S. spends 80 percent more per capita on health care than does Canada, while achieving no better results, but one of the biggest is that Canada has wrung huge amounts of rent out of its health care system and we haven’t. Every Canadian is covered by non-profit rather than profit-maximizing health insurance, and pharmaceutical prices are tightly controlled. By contrast, in the U.S., drug companies overcharge because of patents, Medicare is barred from bargaining for lower drug prices, and private insurers add many costs and inefficiencies.

Or consider our financial sector. Commercial banks, the kind that take deposits and make loans, receive an immensely valuable gift from the federal government: the right to create money. They’re allowed to do this through what’s called fractional reserve banking, which lets them lend, with interest, about ten times more than they have on deposit. This gift alone is worth billions.

Then there are commercial banks’ cousins, investment banks, which are in the business of trading securities. They can’t mint money the way commercial banks do, but they have tricks of their own. For one, they charge hefty fees for taking private companies public, thus seizing part of the liquidity premium public trading creates. For another, they make lofty sums by creating, and then manipulating, hyper-complex financial “products” that are, in effect, bets on bets. This pumps up the casino economy and extracts capital that could otherwise benefit the real economy.

We could wander through other major industries—energy, telecommunications, broadcasting, agriculture—and find similar extractions of rent. What percentage of our economy, then, consists of rent? This is a question you’d think economists would explore, but few do. To my knowledge, the only prominent economist who has even raised it is Joseph Stiglitz, a Nobel laureate at Columbia University, and he hasn’t answered it quantitatively.

The amount of rent in the U.S. economy, Stiglitz says, is “hard to quantify (but) clearly enormous.” Moreover, “to a significant degree,” it “redistributes money from those at the bottom to those at the top.” Further, it not only adds no value to the economy, it “distorts resource allocation and makes the economy weaker.”

SO FAR I’VE DESCRIBED rent as a negative force in our economy. Now I want to introduce the concept of virtuous rent, a form of rent that would have distinctly positive effects.

A perfect example of virtuous rent is the money paid to Alaskans by the Alaska Permanent Fund. Since 1980, the Permanent Fund has distributed equal yearly dividends to every person who resides in Alaska for one year or more. The dividends—which have ranged from $1,000 to $3,269 per person —come from a giant mutual fund whose beneficiaries are all the people of Alaska, present and future. The fund is capitalized by earnings from Alaska’s oil, a commonly owned resource. Given the steady flow of cash to its entire population, it’s not surprising that Alaska has the highest median income and one of the lowest poverty rates of any state in the nation.

Broadly speaking, virtuous rent would be any flow of money that starts by raising the cost of harmful or extractive activity and ends by increasing the incomes of all members of society. Another way to think of it is as rent that we, as collective co-owners, charge for private use of our common assets. Think, for example, of charging polluters for using our common atmosphere and then sharing the proceeds equally.

There are two key differences between traditional and virtuous rent. The first has to do with how the rent is collected, the second with how it’s distributed.

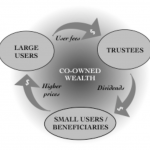

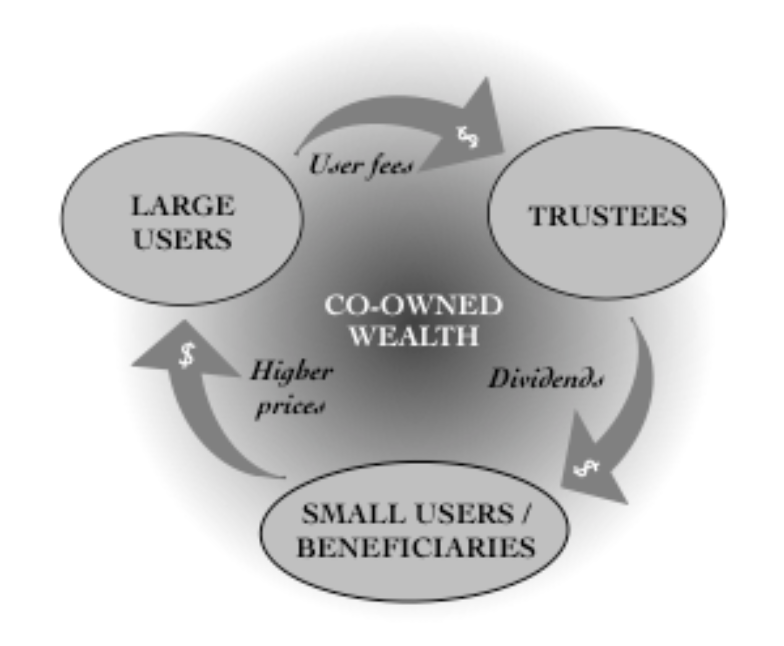

Traditional rent is collected by businesses whose market and/or political power enables them to charge higher-than-competitive prices. It leads to higher prices that serve no economic, social or ecological function. Virtuous rent, by contrast, would be collected by not-for-profit trusts that represent all members of a polity equally. It would be generated by charging private businesses for using common assets that most of the time they use for free. Such rent would also lead to higher prices, but for good reasons: to make businesses pay costs they currently shift to society, nature and future generations, and to offset traditional rent.

The second difference is distributional. Traditional rent flows upward to the small minority that owns most of the stock of rent-extracting businesses. Virtuous rent would flow to everyone equally.

When collection and distribution are merged, the effects of traditional rent are doubly negative: it diminishes the efficiency of our economy and the incomes of all those who pay it but don’t get any. The effects of virtuous rent, by contrast, are doubly positive: it increases the health and fairness of our economy and the security of our middle class.

At this moment, of course, traditional rent totals trillions of dollars a year, while virtuous rent (outside of Alaska) is more of a concept than a reality. But virtuous rent can and should grow. To understand how this could happen, it’s necessary to explore two other concepts: common wealth and externalities.

Common wealth has several components. One consists of gifts of nature we inherit together: our atmosphere and oceans, watersheds and wetlands, forests and fertile plains, and so on. In almost all cases, we overuse these gifts because there’s no cost attached to using them.

Another component is wealth created by our ancestors: sciences and technologies, legal and political systems, our financial infrastructure, and much more. These confer enormous benefits on all of us, but a small minority reaps far more financial gain from them than do most of us.

Yet another chunk of common wealth is what might be called “wealth of the whole”—the value added by the scale and synergies of our economy itself. The notion of “wealth of the whole” dates back to Adam Smith’s insight two-and-a-half centuries ago that labor specialization and the exchange of goods —pervasive features of a whole system—are what make nations rich. Beyond that, it’s obvious that no business can prosper by itself: all businesses need customers, suppliers, distributors, highways, money and a web of complementary products (cars need fuel, software needs hardware, and so forth). So the economy as a whole is not only greater than the sum of its parts, it’s an asset without which the parts would have almost no value at all.

The sum of wealth created by nature, our ancestors and our economy as a whole is what I here call common wealth. Several things can be said about our common wealth. First, it’s the goose that lays almost all the eggs of private wealth. Second, it’s extremely large but also (like the dark matter of the universe) mostly invisible. Third, because it’s not created by any individual or business, it belongs to all of us jointly. And fourth, because no one has a greater claim to it than anyone else, it belongs to all of us equally, or as close to equally as we can arrange.

The big, rarely asked question about our current economy is who gets the benefits of common wealth? No one disputes that private wealth creators are entitled to the wealth they create, but who is entitled to the wealth we share is an entirely different question. My contention is that the rich are rich not so much because they create wealth, but because they capture a much larger share of common wealth than they’re entitled to. Another way to say this is that the rich are as rich as they are—and the rest of us are poorer than we should be—because extracted rent far exceeds virtuous rent. If that’s the truth of the matter, the solution is to diminish the first kind of rent and increase the second kind.

EXTERNALITIES are a better-known concept than common wealth. They’re the costs businesses impose on others—workers, communities, nature and future generations—but don’t pay themselves. The classic example is pollution.

Almost all economists accept the need to “internalize externalities,” by which they mean making businesses pay the full costs of their activities. What they don’t often discuss are the cash flows that would arise if we actually did this. If businesses pay more money, how much more, and to whom should the checks be made out?

These aren’t trivial questions. In fact, they’re among the most momentous questions we must address in the twenty-first century. The sums involved can, and indeed should, be very large—after all, to diminish harms to nature and society, we must internalize as many unpaid costs as possible. But how should we collect the money, and whose money is it?

One way to collect the money was proposed nearly a century ago by British economist Arthur Pigou, a colleague of Keynes’ at Cambridge. When the price of a piece of nature is too low, Pigou said, government should impose a tax on using it. Such a tax would reduce our usage while raising revenue for government.

In theory Pigou’s idea makes sense; the trouble with it lies in implementation. No western government wants to get into the business of price-setting; that’s a job best left to markets. And even if politicians tried to adjust prices with taxes, there’s little chance they’d get them “right” from nature’s perspective. Far more likely would be tax rates driven by the very corporations that dominate government and overuse nature now.

An alternative is to bring some non-governmental entities into play; after all, the reason we have externalities in the first place is that no one represents stakeholders harmed by shifted costs. But if those stakeholders were represented by legally accountable agents, that problem could be fixed. The void into which externalities now flow would be filled by trustees of common wealth. And those trustees would charge rent.

As for whose money it is, it follows from the above that payments for most externalities—and in particular, for costs imposed on living creatures present and future—should flow to all of us together as beneficiaries of common wealth. They certainly shouldn’t flow to the companies that impose the externalities; that would defeat the purpose of internalizing them. But neither should they flow to government, as Pigou suggested.

In my mind, there’s nothing wrong with government taxing our individual shares of common wealth rent, just as it taxes other personal income, but government shouldn’t get first dibs on it. The proper first claimants are we, the people. One could even argue, as economist Dallas Burtraw has, that government capture of this income may be an unconstitutional taking of private property.

THIS BRINGS US BACK to virtuous rent. There are several points that can be made about this sort of rent.

First, paying virtuous rent to ourselves has a very different effect than paying extractive rent to Wall Street, Microsoft or Saudi princes. In addition to discouraging overuse of nature, it returns the money we pay in higher prices to where it does our families and economy the most good: our own pockets. From there we can spend it on food, housing or anything else we choose. Such spending not only helps us; it also helps businesses and their employees. It’s like a bottom-up stimulus machine in which the people rather than the government do the spending. This is no trivial virtue at a time when fiscal and monetary policy have both lost their potency.

VIRTUOUS RENT

Second, virtuous rent isn’t a set of government policies that can be changed when political winds shift. Rather, it’s a set of pipes within the market that, once in place, will circulate money indefinitely, thereby sustaining a large middle class and a healthier planet even as politicians and their policies come and go.

And third, though virtuous rent requires government action to get started, it has the political virtue of avoiding the bigger/smaller government tug-of-war that paralyzes Washington today. It thus can appeal to voters and politicians in the center, left and right.

A TRIM TAB is a tiny flap on a ship or airplane’s rudder. The designer Buckminster Fuller often noted that moving a trim tab slightly turns a ship or a plane dramatically. If we think of our economy as a moving vessel, the same metaphor can be applied to rent. Depending on how much of it is collected and whether it flows to a few or to many, rent can steer an economy toward extreme inequality or a large middle class. It can also guide an economy toward excessive use of nature or a safe level of use. In other words, in addition to being a wedge (as Henry George put it), rent can also be a rudder. An economy’s outcomes depend on how we turn the rudder.

Think about the board game Monopoly. The object is to squeeze so much rent out of other players that you wind up with all their money. You do this by acquiring monopolies and building hotels on them. However, there’s another feature of the game that offsets this extracting of rent: all players get a cash payment when they pass Go. This can be thought of as virtuous rent.

As Monopoly is designed, the rent extracted through monopoly power greatly exceeds the virtuous rent players receive when passing Go. The result is that the game always ends the same way: one player gets all the money. But suppose we tip the scale the other way. Suppose we decrease the extracted rent and increase the virtuous kind. For example, we could pay players five times as much for passing Go and reduce hotel rents by half. What then happens?

Get Evonomics in your inbox

Instead of flowing upward and concentrating in the hands of a single winner, rent flows more evenly. Instead of the game ending when one winner takes all, the game continues with many players remaining.

The point I wish to make is that different rent flows can steer a game—and more importantly, an economy—toward different outcomes. Among the outcomes that can be affected by differing rent flows are the levels of wealth concentration, pollution and real investment as opposed to speculation.

Rent, in other words, is a powerful tool. And it’s also something we can fiddle with. Do we want less extracted rent? More virtuous rent? If so, it’s up to us to build the pipes and turn the valves.

2016 August 10

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!