The unequal distribution of costs and benefits across society is one of the hottest topics in the regulatory arena—and one that, regretfully, has sparked fundamentally flawed arguments, threatening to distort and obscure much-needed discussion about redistributive policies.

To the extent that a regulation correcting an externality or other market failure provides total benefit in excess of total cost while particularly helping the disadvantaged subsets of society, the regulation may—and in my view, should—be seen as doubly wise. If, instead, the regulation creates positive net benefit but requires the poor to pay the costs so that the rich can reap health or environmental benefits, it may be neither just nor wise.

Although all policies have redistributive effects, some ideologies are viscerally, even militantly, opposed to government interventions that benefit the poor, whether by intention or even as a side effect of an otherwise sound policy. The economist A.O. Hirschman asserts in his book, The Rhetoric of Reaction, that both conservatives and progressives promote different flawed narratives in order to rationalize their policy preferences. But it is conservatives, according to Hirschman, who uniquely tend to argue that even when good intentions do not backfire, they simply are futile.

Get Evonomics in your inbox

In a recent New York Times op-ed, University of Illinois at Chicago Professor Deirdre McCloskey exemplifies this type of argument, in conspicuously misguided fashion. In her column, McCloskey offers a litany of reasons as to why progressive taxation and other policies aimed at redistributing benefits to the poor are ill-advised. At the core of the essay, McCloskey makes the empirical assertion that such policies cannot actually make much of a difference in any event.

Unfortunately, the basic mathematics of McCloskey’s claim are mangled. She may not prefer that we seek progressive tax and regulatory policies, but her claim that these policies do not “uplift the poor very much” is erroneous. That the Times has decided not to correct her error—even in the face of an email exchange in which the author herself acknowledged her mistake—may be an example of how tempting it is to ascribe black-and-white factual issues to the realm of “healthy controversy.”

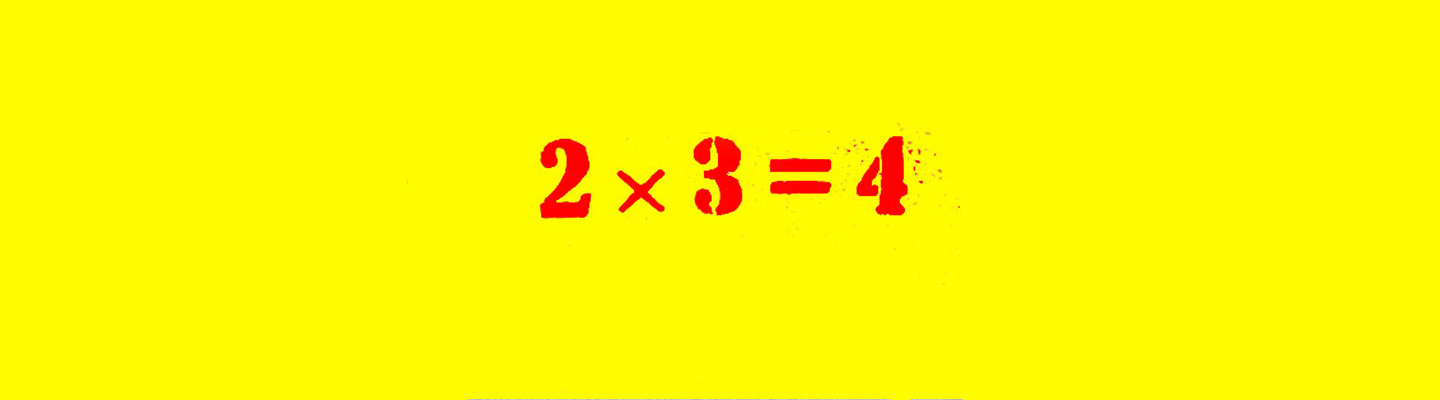

McCloskey states that “[a]s a matter of arithmetic, expropriating the rich to give to the poor does not uplift the poor very much. If we took every dime from the top 20 percent of the income distribution and gave it to the bottom 80 percent, the bottom folk would be only 25 percent better off.”

It was obvious to me, and I hope to others, that McCloskey’s math is only correct in the extreme and unrealistic situation where there is zero inequality—that is, no “distribution” at all—to begin with. If in a population of 1,000 people, each person had exactly the same $500,000 in wealth, then it is true that if the entire $100 million that the “top” 200 people held were transferred to the “other” 800 people and split equally among them, those 800 people would be given $125,000 each, which would indeed increase their individual wealth by 25 percent.

In the real United States, however—where $500,000 is indeed a reasonable estimate of the average individual net worth, but where the top 20 percent own 85 percent of all wealth—the math is very different. Among a representative sample of 1,000 Americans, there would be $425 million to redistribute among the bottom 800 people, who would each start with only $93,750. These 800 individuals would receive $531,250 more from the rich, increasing their wealth by 570 percent—not 25 percent. Thus, the only plausible takeaway of McCloskey’s example is that soaking the rich might conceivably help the poor “not very much”—but only if the “poor” are as rich as the rich to begin with! Unfortunately, readers may have come away with the comforting and self-serving “knowledge” that the pie is not big enough to meaningfully help the poor, so why bother trying?

In reality, imposing a policy of redistribution down the economic ladder—whether through the tax code, regulation, or any other means—could help the poor immensely. So should we adopt such policies? Of the many arguments McCloskey offers as to why redistribution is wrong-headed and futile, I disagree with two in particular.

First, McCloskey asserts that once the poor have “a roof over their heads and enough to eat,” they have no further need for any of society’s accumulated wealth. Elsewhere, she claims that all progressives seek a “forced equality” that would require brain surgeons and taxi drivers to earn the same amount. The former assertion is callous , and the latter is a strawman: even the most repressive Communist regimes in history sought equality of opportunity—not equality of outcome. Surely, somewhere within the 99 percent of the ideological distribution between dystopian Darwinism and utopian equality-for-its-own-sake, there is room for fruitful discussion about whether we should favor some modest redistribution via a progressive tax code and social programs. But McCloskey’s caricature of both positions makes any compromise impossible.

Second, McCloskey refers to taxation as “state violence,” “compelled equality,” and “envy-and-anger-satisfying extraction from the rich.” What can one say to this view of community-as-prison, other than to say that McCloskey does not speak for me, and many like-minded friends and colleagues: I have zero envy for the hardworking, lucky, or rapacious folks who are rich compared to me. I simply contribute—both voluntarily and compulsorily, and without rancor—and I expect the wealthier in society to do as much, or more, with their surpluses.

I recognize, of course, that McCloskey’s substantive views are shared by others and that reasonable people can differ on how much redistribution society should pursue. But we can have no meaningful dialogue about the costs and benefits of modestly progressive policies if that discussion is grounded in “alternative math.” It is possible to argue that the rich should not help uplift the poor, without making the claim that they cannot do so as a matter of “arithmetic.”

As with many of the toxic myths about regulation—that, for example, it is responsible for destroying countless jobs while failing to create any new ones in the process, or that it relies on gross exaggerations of risk and plays to irrational public fears—we are lost without the ability to distinguish between ideological responses to facts and ideological twisting of facts into nonsense. In recent weeks, likely in response to being tarred as “fake news” by the new Administration, the Times launched an impressive ad campaign (print ads and a Super Bowl commercial). I agree: the truth about data, algebra, and policies is indeed “more important than ever.”

Originally published at RegBlog here.

2017 March 18

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

The Trump Presidency: An Embarrassment for Those Who Believe in the Market

How a Ruthless Network of Super-Rich Ideologues Killed Choice and Destroyed People’s Faith in Politi...

How to Unite Nations to Deal with Climate Change: Introducing New Multilateralism

Why Society’s Biggest Freeloaders are at the Top

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!