There is no higher God in Silicon Valley than growth. No sacrifice too big for its craving altar. As long as you keep your curve exponential, all your sins will be forgotten at the exit.

It’s through this exponential lens that eating the world becomes not just a motto for software at large, but a mission for every aspiring unicorn and their business model. “Going viral” suddenly takes on a shockingly honest and surprisingly literal meaning.

Get Evonomics in your inbox

The goal of the virus is to spread as fast as it can and corrupt as many other cells as possible. How on earth did such a debauched zest become the highest calling for a whole generation of entrepreneurs?

Through systemic incentives, that’s how. And no incentive is currently stronger than that of THE POTENTIAL.

It used to be that successful, upcoming companies would show a prudent mix of present-day profits and future prospects, but such a mix is now considered old-fashioned and best forgotten. Now it’s all potential, all the time.

This trend didn’t start yesterday. We can’t blame the current crop for soil spoiled five harvests ago. No, this singular focus on potential, forsaking all present-day considerations, was cultivated by some of our current giants.

It’s companies like Salesforce that have shown just how long you can live on potential alone. Just how large and sprawling you can become without ever bothering to show much if any profits. There’s a decade and more’s proof that growing like a virus, gobbling up other businesses to cling to the exponential, is how you can be “successful”.

There’s always more potential. Always another idea or domain that can be devoured. But this is also the straight path to devolution and its distortions. Bright ideas boiled free of all that is good and left dry as bones.

Have you tried Angry Birds lately? It’s a swamp of dark patterns. All extractive logic meant to trick you into another in-app payment. It’s the perfect example of what happens when product managers have to squeeze ever-more-growth out of ever-less-fertile lands to hit their targets year after year.

It’s straight out of the split-pea soup parable. What if we removed just three peas? Nobody can tell. The factory can save a few million. The executives who pushed that idea can get their yearly bonus. No harm, no foul? But nothing ever stops at the quarterly win. There are four quarters to a year. Forty to a decade. Every one of them has to produce, exceed, and beat EXPECTATIONS.

Because the core assumption is that growth is always good, growth is always unlimited, and if you’re not growing you’re dying. Swim or sink, no wading.

It’s the banality of moral decline. No one person sits down and imagines that Angry Birds of 2009 becomes the Angry Birds of 2017. A fun, novel game turned into a trashy slot machine. Nobody is proud of work like that. But it happens. One pea at a time. Until the split-pea soup has no more peas.

We cannot expect otherwise. It takes superhuman strength to resist the compound expectations of quarterly growth targets linked to an exponential moon shot. The list of comic-book heroes capable of such a task is so short that we’ve already deified the few, like Steve Jobs, who held the line. (And who knows where he would have gone given another decade or two?)

Remember “Don’t be evil”? Google’s iconoclastic corporate slogan that slowly but surely accumulated so many caveats and exceptions that it needed as much legalese as a terms of service agreement. Principles are no match for the long-term corrosion of market realities and expectations. The levies will break, the good intentions will flood.

But back to the incentives. It’s not just those infused by venture capital timelines and return requirements, but also the likes of tax incentives favoring capital gains over income.

What sucker wants to earn $10 million/year at a 52.5% tax rate when you can get away with hundreds of millions in one take at just 15%? Nobody, that’s who.

It’s hard to argue that boards, founders, and their financiers aren’t just doing exactly what the incentives are coaxing them to do.

Which is why growth is now everything and residual value is nothing. In fact, the latter can be outright harmful to the former. When you’re being priced on the hopes and dreams of potential, reality can be a dangerous and undesired competitor. Best just to appeal to the exponential curve and let the imagination roam free. An epic capital gains score awaits!

Given how pervasive this worship of potential and growth has become, it wasn’t surprising that when we pruned the product portfolio at 37signals a few years back, and left only Basecamp, the reaction was mostly one of incredulity, or even anger. Either we were cutting businesses that were devoid of financial merit, or they had merit, and we were thus per definition crazy to let them die. Crazy to turn down growth. To summarize the ethos of the comments sections back then: If something is creating revenue, it’s your solemn duty to keep milking and pumping until it’s done! Extract every cent, then move on to the next mining effort.

The fancy word for that is fiduciary duty. To grow as fast as inhumanely possible is not just a goal, but a responsibility. A moral obligation to THE MARKET. And the theory goes, the market is all of us*. So you’re actually serving your community. All that is bad is good again once you change the tint of your glasses. If you sense something rotten, you just need a new prescription. Now you’ll see as clear as fog that this is ACTUALLY ABOUT ETHICS IN BUSINESS.

The true puppeteer behind this homogenization of startup aspirations is diversification theory. Decisions are not driven by what’s good for a single company, its employees, and its customers. No, it’s what’s good for the basket.

These baskets are known as venture capital funds. That’s the pipeline through which virtually all recent tech companies that have reached the public markets were sent. It’s a gladiatorial arena with the explicit goal that if enough businesses in the basket aren’t failing, the fund isn’t trying hard enough! Not dreaming big enough! Be more outrageous! Be more crazy!

It’s a hyper-evolutionary process that rewards the most extractive, most addictive, most viral strain from the cohort. The key measurement is ENGAGEMENT. Who cares about the virtue of the endeavor, as long as your product is maximally addictive.

Engagement, of course, is not a new pursuit. It’s just the latest euphemism for what we used to call capturing eyeballs. But I guess that was a bit too blunt and honest to survive the sanitization of the industry. The collective ecosystem learns and adapts at an incredible pace, including how best to position its image to incite the least amount of skepticism. They have better words now to hide the same scheme in plain sight. The normalization of questionable motives in the public perception is key to enabling the next iteration to proceed without obstacle.

And iterate they do. At a furious pace. Every new fund is competing against the survivors of the last one and the more purpose-bred contenders of the current one. It’s what makes looking at the values and principles of today so fascinating and frightening. If this is where things stand in 2016, what does 2020 look like? 2024? 2030? The mutations will continue. And they absolutely will not stop until every last one of us has been through the funnel and converted to a servile consumer as ingredients in the sludge of growth.

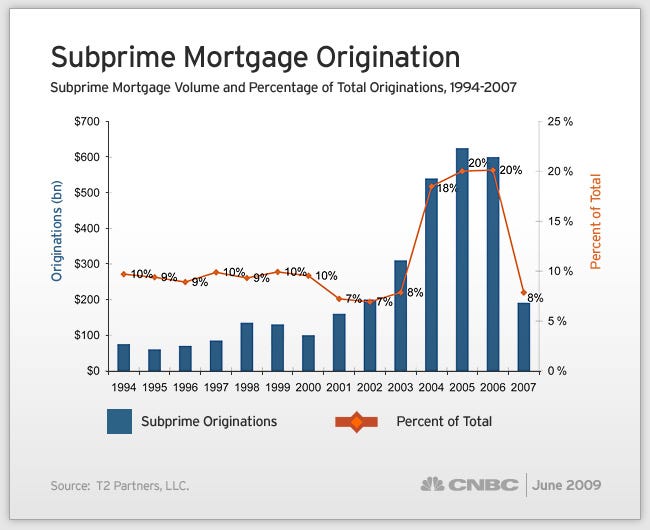

Innovation, risk, and morals are being packaged with ever greater efficiency through startup accelerators that take the raw ingredients, preferably pattern-matched look-alikes of Zuckerberg, and turn them into securitized batches of startups. Whole tranches of burgeoning businesses packaged into Spring and Fall cohorts. This packaging has turned out to be a great model for the packagers. Many small sums spent on 7% of ownership. If you package enough entrepreneurial product, your actuary tables will line up beautifully.

And you get to indoctrinate these seeds with the values and practices of the most successful viral strains from last season. Genetically modified, cloned, and inoculated startup founders with all the right bits, flipped to ensure the greatest chance of the biggest yield.

But what is a conscientious objector to do? Time waits for no one, and only the Luddites think that their home too won’t one day soon be configured with BUY NOW buttons for all the beloved BRANDS. Controlled by a friendly bot in the cloud that learns all your habits, preferences and titillations one command at a time. Data mining has also successfully been rebranded to the more palatable Machine Learning. Who wants to stop anyone, human or machine, from learning? What are you, the digital taliban?

So too with the startups themselves: “If we don’t, we’re leaving money on the table!!”. Has there ever been a more gluttonous justification for guiltless business practices?

Could it be that perfecting the most viral superbug — until the final strain is discovered that really DOES devour the whole world — isn’t what the whole startup community should be focused on? What if we opened our eyes to non-exponential startups and the needs they may have instead.

But again, don’t you know businesses are valued on future potential, not present reality? Yes I do. And that’s my objection. Surely a mix is prudent, but the spectrum has gotten out of whack. To the point where the present is entirely discounted by the lure of the future. And the past, what it took to get where we are, is either ignored or forgiven. Mistakes may have been made, but tomorrow is an entirely new day, divorced from any of the days that went before it. It’s a constant cycle of absolution combined with a community-induced amnesia to past transgressions. It’s just more efficient that way.

Technology isn’t the only industry that grapples and struggles with growth, so we can learn from studying others suffering the same pressures. Take the drug business. It costs staggering sums to develop a new mass-market drug, and it’s a risky endeavor, so we reward the explorers with a patent monopoly when they strike gold. But it’s not a permanent one. There’s a time limit, and after that generics distribute the gains of progress widely without the yoke of a profit-maximization goal.

What if we thought about how we could apply some of that to the world of software? How can we turn more of the Twitters and Facebooks and Googles into generics? What shifts in underlying technology and cost do we need to hit to make it feasible to run something like Twitter on Wikipedia’s budget (and fund it by donations rather than ads)? What if the next Big Idea looked more like email and less like the walled gardens of today?

We’ve made this transition at the infrastructural level, to some extent. Technological and algorithmic advances from closed-source software have been turned into generics via open source. With spectacular commercial success, no less. As one boat sinks, a thousand new ones float. One software company or product’s death is easier to celebrate, rather than mourn, when you know the intellectual organs are giving life to ten new ones.

Additionally, startup culture used to focus a lot on the personal risk of the founders and early employees. To a nauseating degree, yes. This heroism was the justification for all the spoils there were to come. These days, there’s a lot less talk of existential risk because there’s a lot less of it. There’s so much money floating around that for many founders, the risk is mostly gone. At least in the financial sense, if not in the moral and time-opportunity sense. Failure is celebrated to such a degree in part because the system needs to recycle able bodies as quickly as it can to keep the overall system growing. Spent three years on a startup that didn’t work out? No sweat, bro. Here’s a hug and a reboot and a new bag of money to try again. You’re here just in time for my next fund!

Now some of that is clearly good. Less extreme risk means, at least in theory, greater access for more people to participate in the startup lottery. But it also has some clear downsides of detachment. If this go is just one of many, if you can always just hit restart, then you’re probably not as concerned about this specific go-around. So what if we step over the line a little here. ITS THE HUSTLE, BABY! And besides, if we miss, no biggie.

Maybe it’s time we rediscover some personal liability. Limited, yes, none, no. Complete detachment from the consequences of your choices isn’t producing the kind of responsibility the world so dearly needs.

But that’s hard. Of course it’s hard. Not the least because this whole adventure is so heavily medicated with foosball tables, game rooms, and bean bags of all colors. As many distractions as possible from having to consider the true nature of what we’re doing. What’s that about the rising automatron class? Sorry, I’m late for a nerf battle on the star deck. Later!

Yeah, the automatron class. People treated as literal cogs in transportation and delivery machines. Complete with machine-like tolerance specifications for quality. Dip below a 4.7? You’re in trouble. No explanations. No room for a bad day or a bad week because the bills were mounting. No room for humanity, no room for frailty. Just put on your happy face and Have A Great Day.

I’ve been as guilty of this as anyone. When I first discovered Uber, I was ecstatic. So much less human friction. No yucky money changing hands. Just in and out. Headphones on and let’s go. The less I had to deal with the humanity of drivers, the better. Or so I thought.

But not all that is easy is better. Friction is interaction. Human psyches rubbing against each other. And in this friction-less society we wonder how on earth someone could vote Brexit or Trump. It wouldn’t be such a mystery if we didn’t do all we could to isolate ourselves from the world.

Yet we go along with the euphemisms and fantasies. Oh no, no. These people aren’t cogs, they’re independent business owners! Able to set their own hours: Like whether they want to drive for 60 or 80 a week to make ends meet! Aren’t we liberating?

And I think that’s the truly insidious part of the tech lords solution to everything. This fantasy that they will be greeted as liberators. When the new boss is really a lot like the old boss, except the big stick is replaced with the big algorithm. Depersonalizing all punishment but doling it out just the same. Maybe the old cabbie boss was an asshole, but at least that asshole had a face. Someone you could yell at. Have you tried yelling at an algorithm or a customer-rating average?

It’s just another mass-scale exploitation project. And by exploitation, I mean that less in a shackles and bone-soup sense — although there’s a good discussion to have around that too — but more in a pennies for you, billions for me kind of way. Enormous wealth being extracted from people living subsistence lives. But rather than being seen as modern sweatshops, we are all cheering this on as unadulterated progress. Anyone who’s in opposition to this exploitive process is a crank, as Michael Foley would say. Any community that may have reservations about how this is happening is a shit-hole.

Now that doesn’t mean that there aren’t all sorts of vested, crony interests in keeping innovation at bay. Surely there are. But there’s more than that. There are a whole host of legitimate reasons why we have government regulations around housing and transportation. Inconveniences to the march of Instacart and Uber to turn everyone into a temporary gig worker.

This exploitation isn’t just for the workers of the Uber or the neighbors of Airbnb. It’s also all of us through the algorthimization of news at the House of Facebook’s behest. More engagement. More rage, more fake news, all resulting in more hours spent, more eyeballs fixated, more clicks and taps made.

And this new world order is being driven by a tiny cabal of monopolies. So commercial dissent is near impossible. Do you want to be the weirdo without a Facebook account? The uncool stooge for staying at a motel or taking an old-school cab? Of course not. You’re hip, you’re with it. Everything worth doing is in an app.

So it remains mostly our fault. Our choice, our dollars. Every purchase a vote for an ever more dysfunctional future. We will spend our way into the abyss.

If nothing changes, we’ll continue to vest the tech titans and their lords with economic monopolies that grant them undue power. They’re too big to be conscientious. “Don’t be evil” is a slogan for an upstart, not a conglomerate. You simply can’t distribute such noble a moral codex across endless divisions, all with their own P&Ls.

And don’t fall for the soothing charity by the extractive victors either. That charade is as old as time. It’s the process by which ruthless tech lords seek to rebrand themselves into noble benefactors for the good of society. By giving back some of their spoils as they see fit. Kings of plenty doling out gifts and mercy. Don’t buy it. And I don’t mean that in the sense that, say, Bill Gates hasn’t done good with his fortune. But that society isn’t better off when we have to rely on magnanimous tech lords to solve its ills by decree.

Incumbent power centers will not go quietly into the night, though. Excuses will be aplenty, because unlike the robber barons of old, they’re not going to defend themselves with water canons and lock-outs. It’ll be cold war skirmishes fighting for fake moral high grounds. Natural monopolies! Network effects!

Because competition is for the little people. Pitting one individual contractor against another in a race to the bottom. Hoarding all the bargaining power at the top. Disparaging any attempts against those at the bottom to organize with unions or otherwise. Ragging on that as “untapped energy”.

When you accept this entire picture, it’s not so hard to understand why some people are starting to freak out. I’m freaking out. This is worth freaking out about.

As Douglas Rushkoff says, we need a new operating system for startups. The current one will keep producing the same extractive and monopolistic empires we’ve gotten so far. No, what we need is a new crop of companies that are institutionally comfortable with leaving money on the table. Leaving growth on the table. Leaving some conveniences and some progress on the board, in order to lead the world into a better direction.

The solution isn’t simple, but we’re in dire need of a strong counter culture, some mass infusion of the 1960s spirit. To offer realistic, ethical alternatives to the exponential growth logic. Ones that’ll benefit not just a gilded few, but all of us. The future literally depends on it.

Originally published here. at Signal v. Noise.

David Heinemeier Hansson is the creator of Ruby on Rails, Founder & CTO at Basecamp (formerly 37signals), NYT Best-selling author of REWORK and REMOTE, and Le Mans class-winning racing driver.

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!