Published November 13, 2017

One of the basic claims of capitalism is that people are rewarded in line with their effort and productivity. Another is that the economy is not a zero sum game. The beauty of a capitalist economy, we are told, is that people who work hard can get rich without making others poorer.

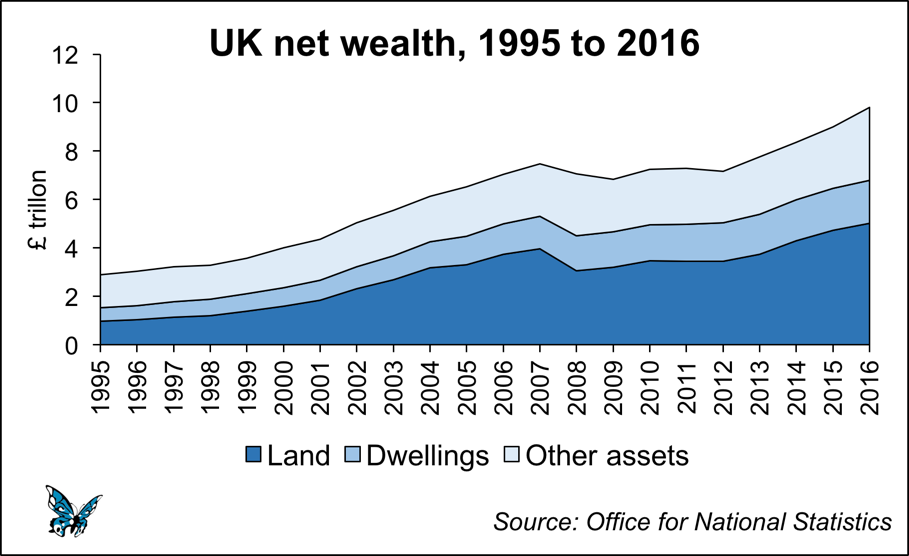

But how does this stack up in modern Britain, the birthplace of capitalism and many of its early theorists? Last week, the Office for National Statistics (ONS) released new data tracking how wealth has evolved over time. On paper, the UK has indeed become much wealthier in recent decades. Net wealth has more than tripled since 1995, increasing by over £7 trillion. This is equivalent to an average increase of nearly £100,000 per person. Impressive stuff. But where has all this wealth come from, and who has it benefitted?

Get Evonomics in your inbox

Just over £5 trillion, or three quarters of the total increase, is accounted for by increase in the value of dwellings – another name for the UK housing stock. The Office for National Statistics explains that this is “largely due to increases in house prices rather than a change in the volume of dwellings.” This alone is not particularly surprising. We are forever told about the importance of ‘getting a foot on the property ladder’. The housing market has long been viewed as a perennial source of wealth.

But the price of a property is made up of two distinct components: the price of the building itself, and the price of the land that the structure is built upon. This year the ONS has separated out these two components for the first time, and the results are quite astounding.

In just two decades the market value of land has quadrupled, increasing recorded wealth by over £4 trillion. The driving force behind rising house prices — and the UK’s growing wealth — has been rapidly escalating land prices.

For those who own property, this has provided enormous benefits. According to the Resolution Foundation, homeowners born in the 1940s and 1950s gained an unearned windfall of £80,000 between 1993 and 2014 alone. In the early 2000s, house price growth was so great that 17% of working-age adults earned more from their house than from their job.

Last week The Times reported that during the past three months alone, baby boomers converted £850 million of housing wealth into cash using equity release products – the highest number since records began. A third used the money to buy cars, while more than a quarter used it to fund holidays. Others are choosing to buy more property: the Chartered Institute of Housing has describedhow the buy-to-let market is being fuelled by older households using their housing wealth to buy more property, renting it out to those who are unable to get a foot on the property ladder. And it is here that we find the dark side of the housing boom.

As house prices have continued to increase and the gap between house prices and earnings has grown larger, the cost of homeownership has become increasingly prohibitive. Whereas in the mid-1990s low and middle income households could afford a first time buyer deposit after saving for around 3 years, today it takes the same households 20 years to save for a deposit. Many have increasingly found themselves with little choice but to rent privately. For those stuck in the private rental market, the proportion of income spent on housing costs has risen from around 10% in 1980 to 36% today. Unlike homeowners, there is no asset wealth to draw on to fund new cars or holidays.

In Britain, we have yet to confront the truth about the trillions of pounds of wealth amassed through the housing market in recent decades: this wealth has come straight out of the pockets of those who don’t own property.

When the value of a house goes up, the total productive capacity of the economy is unchanged because nothing new has been produced: it merely constitutes an increase in the value of the land underneath. We have known since the days of Adam Smith and David Ricardo that land is not a source of wealth but of economic rent — a means of extracting wealth from others. Or as Joseph Stiglitz puts it “getting a larger share of the pie rather than increasing the size of the pie”. The truth is that much of the wealth accumulated in recent decades has been gained at the expense of those who will see more of their incomes eaten up by higher rents and larger mortgage payments. This wealth hasn’t been ‘created’ – it has been stolen from future generations.

House prices are now on average nearly eight times that of incomes, more than double the figure of 20 years ago. It’s unlikely that house prices will be able to outpace incomes at the same rate for the next 20 years. The past few decades have spawned a one-off transfer of wealth that is unlikely to be repeated. While the main beneficiaries of this have been the older generations, eventually this will be passed on to the next generation via inheritance or transfer. Already the ‘Bank of Mum and Dad’ has become the ninth biggest mortgage lender. The ultimate result is not just a growing intergenerational divide, but an entrenched class divide between those who own property (or have a claim to it), and those who do not.

Misleading accounting and irresponsible economics have provided cover for this heist. The government’s national accounts record house price growth as new wealth, ignoring the cost it imposes on others in society – particularly young people and those yet to be born. Economists still hail house price inflation as a sign of economic strength.

The result is a world which is rather different to that described in economics textbooks. Most of today’s ‘wealth’ isn’t the result of entrepreneurialism and hard work – it has been accumulated by being idle and unproductive. Far from the positive sum game capitalism is supposed to be, we have a system where most wealth is gained at the expense of others. As John Stuart Mill wrote back in 1848:

“If some of us grow rich in our sleep, where do we think this wealth is coming from? It doesn’t materialise out of thin air. It doesn’t come without costing someone, another human being. It comes from the fruits of others’ labours, which they don’t receive.”

Britain’s housing crisis is complicated mess. Fixing it requires a long-term plan and a bold new approach to policy. But in the meantime let’s start calling it what it really is: the largest transfer of wealth in living memory.

Originally published on Open Democracy here.

2017, November 13

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!