By Steve Roth

Capitalism concentrates wealth. Ridicule Marx and his latter-day disciples all you like (I’ll help); he definitely got that right.

But capitalism is a big word with lots of meanings, and enough ideological baggage to fill a Lear Jet. Let’s talk about something more precise: perfect markets, with ownership, in which individuals compete with others to produce stuff, and store up savings. You can see this kind of perfect world in agent-based simulations like Sugarscape. Start with a bunch of sugar farmers trying to accumulate sugar in an artificial world, hit Go, and watch what happens.

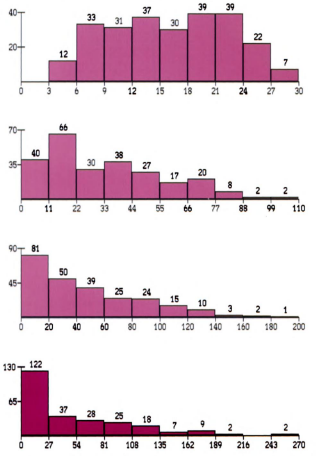

Here’s what happens to wealth concentration (number of poorer farmers on the left, richer on the right):

Wealth is pretty evenly distributed at the beginning (top). That doesn’t last long. You can see the same effect in another Sugarscape run, here compared to real-world wealth distributions:

That’s the Gini coefficient for wealth. Zero equals perfect equality; everyone has equal wealth. 1.0 equals perfect inequality; one person has all the wealth.

Perfect markets concentrate wealth. It’s their nature. But at some point, market-generated wealth concentration strangles those very markets (compared to markets with broader distributions of wealth). If a handful of people have all the wealth, how many iPhones will Apple sell? If only a few have the wealth to buy cars, automakers will produce a handful of million-dollar Bugattis, instead of forty handfuls of $25,000 Toyotas. Sounding familiar?

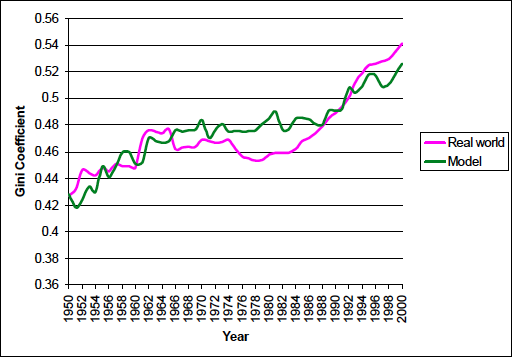

But wealth concentration doesn’t just strangle the flows of spending, production, and income. It throttles the accumulation of wealth itself. Another simple simulation of an expanding economy (details here) explains this:

The dynamics are straightforward here: poorer people spend a larger percentage of their wealth each year than richer people. So if less money is transferred to richer people (or more to poorer people), there’s more spending — so producers produce more (incentives matter), there’s more surplus from production, more income, more wealth…rinse and repeat.

This picture says nothing about how the wealth transfers happen (favored tax rates on ownership income, transfers to poorer and older folks, free public schools, Wall Street predation, the list is endless). It just shows the results: As wealth is transferred up to the rich, on the left, and wealth concentration increases, our total wealth increases more slowly. When that transfer is extreme, even in this growing economy the poorer people end up with less wealth. (Note how the curves get steeper on the left.) As wealth concentration declines on the right, our total wealth increases faster, and poorer people’s wealth increases much faster. Note that richer people still get richer in most scenarios — it’s a growing economy, always delivering a surplus from production, and increasing wealth — just more slowly.

And that’s just talking dollars. If we start thinking about our collective “utility,” or well-being — the total of everybody’s well-being, all summed up — the effects of wealth concentration are even more profound. Because poorer people getting more does a lot more for their well-being than richer people getting more. (Likewise, even if the richer people actually lose some of their wealth, they’re not losing as much utility.)

Because: Declining marginal utility of wealth (or consumption, or whatever). This is one of those Econ 101 psychological truisms that seems to actually be true. The fourth ice-cream cone (or Bugatti, or iPhone) just doesn’t deliver as much utility as the first one. Plus, a Bugatti in one person’s hands doesn’t deliver as much utility as forty Toyotas in forty people’s hands. (Prattle on all you want about relative and revealed preferences; you won’t alter this reality.)

So if we were to re-work the chart above showing utility instead of dollars, you’d see far greater increases in utility on the right side, especially for poorer people. Widespread prosperity both causes and is greater prosperity.

Why, then, aren’t we spending our lives on the right side of this chart? It’s a total win-win, right? The answer is not far to find. Nassim Taleb shows with some impressive math (PDF) what’s also easy to see with some arithmetic on the back of an envelope: if a few richer people (who dominate our government, financial system, and economy) have the choice between making our collective pie bigger or just grabbing a bigger slice, grabbing the bigger slice is the hands-down winner.

Get Evonomics in your inbox

That’s why decades of Innovative Financial Engineering has served, mostly, not to efficiently allocate resources to efficient producers, improve productivity, or increase production. Rather, these fiendishly clever entrepreneurial inventions control who gets the income from production. You can guess who wins that game. Top wealth-holders would be nuts to play it any other way (if you go with economists’ definition of rationality…).

But for the rest of us, it’s a loser’s game — at least compared to the world we could be living in. If household incomes had increased along with GDP, productivity, and other economic-growth measures for the last two or four decades, a typical household would have tens of thousands of dollars more to spend each year — and much bigger stores of wealth to draw on. If you think that sounds like a thriving, prosperous society…you’re right.

To summarize: perfect markets, left to their own devices, concentrate wealth. Concentrated wealth results in less wealth, and far less collective well-being. (You’ll notice that I haven’t even mentioned fairness. It matters. But I’ll leave that to my gentle readers.)

This all leads one to wonder: how could we move ourselves into that happy world of rapidly increasing wealth and well-being on the right side of the graph? Hmmmm….

Cross-posted at Asymptosis.

2016 June 5

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!