At least nominally, capitalism embodies and sustains an Enlightenment agenda of freedom and equality. Typically there is freedom to trade and equality under the law, meaning that most adults – rich or poor – are formally subject to the same legal rules. But with its inequalities of power and wealth, capitalism nurtures economic inequality alongside equality under the law.

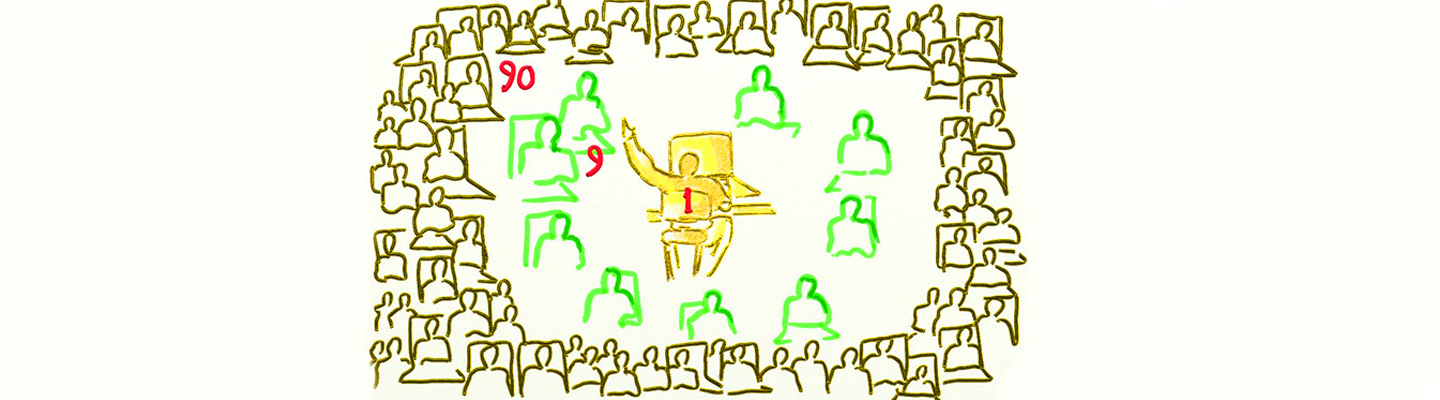

Today, in the USA, the richest 1 per cent own 34 per cent of the wealth and the richest 10 per cent own 74 per cent of the wealth. In the UK, the richest 1 per cent own 12 per cent of the wealth and the richest 10 per cent own 44 per cent of the wealth. In France the figures are 24 cent and 62 per cent respectively. The richest 1 percent own 35 percent of the wealth in Switzerland, 24 per cent in Sweden and 15 percent in Canada. Although there are important variations, other developed countries show similar patterns of inequality within this range.[1]

Get Evonomics in your inbox

In their book The Spirit Level, Richard Wilkinson and Kate Pickett showed multiple deleterious effects of inequalities of income and wealth. Using data from twenty-three developed countries and from the separate states of the United States, they observed negative correlations between inequality, on the one hand, and physical health, mental health, education, child well-being, social mobility, trust and community life, on the other hand. They also found positive correlations between inequality and drug abuse, imprisonment, obesity, violence, and teenage pregnancies. They suggested that inequality creates adverse outcomes through psycho-social stresses generated through interactions in an unequal society.

Although economic inequality is endemic to capitalism, data gathered by Thomas Piketty in his Capital in the Twentieth Century, and in my book entitled Conceptualizing Capitalism, show that there are large variations in measures of inequality in different major capitalist countries, and through time. The existence of such variety within capitalism suggests that it possible to alleviate inequality, to a significant degree, within capitalism itself.

But first we must be clear about the drivers of inequality within the system. What are the mechanisms within capitalism that exacerbate inequalities of income or wealth?

Some inequality results from individual differences in talent or skill. But this cannot explain the huge gaps between rich and poor in many capitalist countries. Much of the inequality of wealth found within capitalist societies results from inequalities of inheritance. The process is cumulative: inequalities of wealth often lead to differences in education, economic power, and further inequalities in income.[2]

Do markets create inequality?

To what extent can inequalities of income or wealth be attributed to the fundamental institutions of capitalism, rather than a residual landed aristocracy, or other surviving elites from the pre-capitalist past? A familiar mantra is that markets are the source of inequality under capitalism. Can markets be blamed for inequality?

In real-world markets different sellers or buyers vary hugely in their capacities to influence prices and other outcomes. When a seller has sufficient saleable assets to affect market prices, then strategic market behaviour is possible to drive out competitors.

Would more competition, with greater numbers of market participants, fix this problem? If markets per se are to be blamed for inequality, then it has to be shown that competitive markets also have this outcome. Unless we can demonstrate their culpability, blaming competitive markets for inequalities of success or failure might be like blaming the water for drowning a weak swimmer.

To demonstrate that competitive markets are a source of inequality we would have to start from an imagined world where there was initial equality in the distribution of income and wealth, and then show how markets led to inequality. I know of no such theoretical explanation.

Markets involve voluntary exchange, where both parties to an exchange expect benefits. One party to the exchange may benefit more than the other; but there is no reason to assume that individuals who benefit more, or benefit less (in one exchange) will generally do so. And if some traders become more powerful in the market than others, then its competitiveness is reduced.

There is another reason why it is a mistake to focus on markets. In the sense of organized arenas of exchange, markets have existed for thousands of years. We need to look at new institutional drivers of inequality that became prominent in the last 400 years or so. These new institutional changes were additional to markets.

The sources of inequality within capitalism

So if markets per se are not the root cause of inequality under capitalism, then what is? A clear answer to this question is vital if effective policies to counter inequality are to be developed. Capitalism builds on historically-inherited inequalities of class, ethnicity, and gender. By affording more opportunities for the generation of profits, it may also exaggerate differences due to location or ability. Partly through the operation of markets, it can also enhance positive feedbacks that further magnify these differences. But its core sources of inequality lie elsewhere.

Because waged employees are not slaves, they cannot use their lifetime capacity for work as collateral to obtain money loans. The very commercial freedom of workers denies them the possibility to use their labour assets or skills as collateral. By contrast, capitalists may use their property to make profits, and as collateral to borrow money, invest and make still more money. Differences become cumulative, between those with and without collateralizable assets, and between different amounts of collateralizable wealth. Even when workers become home-owners with mortgages, the wealthier can still race ahead.

Unlike owned capital, free labour power cannot be used as collateral to obtain loans for investment. At least in this respect, capital and labour do not meet on a level playing field, this asymmetry is a major driver of inequality.

The foremost generator of inequality under capitalism is not markets but capital. This may sound Marxist, but it is not. In my Conceptualizing Capitalism I define capital differently from Marx and from most other economists and sociologists. My definition of capital corresponds to its enduring and commonplace business meaning. (Piketty’s definition is also similar to mine.) Capital is money, or the realizable money-value of collateralizable property. Unlike labour, capital can be used as collateral and the loan obtained can help generate further wealth.

Because workers are free to change jobs, employers have diminished incentives to invest in the skills of their workforce. Especially as capitalism becomes more knowledge-intensive, this can create an unskilled and low-paid underclass and further exacerbate inequality, unless compensatory measures are put in place. A socially-excluded underclass is observable in several developed capitalist countries.

Another source of inequality results from the inseparability of the worker from the work itself. By contrast, the owners of other factors of production are free to trade and seek other opportunities while their property makes money or yields other rewards. This puts workers at a disadvantage. Through positive feedbacks, even slight disadvantages can have cumulative effects.

None of these core drivers of inequality can be diminished by extending markets or increasing competition. These drivers are congenital to capitalism and its system of wage labour. If capitalism is to be retained, then the compensatory arrangements that are needed to counter inequality cannot simply be extensions of markets or private property rights.

These ineradicable asymmetries between labour and capital mean that ultra-individualist arguments against trade unions are misconceived. In a system that is biased against them, workers have a right to organize and defend their rights, even if it reduces competition in labour markets.

Reducing inequality – within capitalism

The twentieth-century socialist experiments in Russia and China undermined human rights in their efforts to reduce inequality. This is not a road that we should attempt to follow.

Instead, we have to look at ways of reducing inequality within capitalism, and which do not undermine capitalism’s unparalleled capacity to increase productivity and generate wealth.

Long ago, Thomas Paine (1737-1809) argued for an inheritance tax, but balanced this by a grant to each adult at reaching the age of maturity. In this way, wealth would be recycled from the dead to the young, providing greater equality of opportunity across the board. Paine also advocated welfare provision and a guaranteed pension for those over 50.

Get Evonomics in your inbox

Bruce Ackerman and Anne Alstott took up Paine’s agenda in their proposal for a ‘stakeholder society.’ They argued that ‘property is so important to the free development of individual personality that everybody ought to have some’. They echoed Francis Bacon: ‘Wealth is like muck. It is not good but if it be spread.’

Ackerman and Alstott stressed progressive taxes on wealth rather than on income. Echoing Paine, they proposed a large cash grant to all citizens when they reach the age of majority, around the benchmark cost of taking a bachelor’s degree at private university in the United States. This grant would be repaid into the national treasury at death. To further advance redistribution, they argued for the gradual implementation of an annual wealth tax of two percent on a person’s net worth above a threshold of $80,000. Like Paine, they argued that every citizen has the right to share in the wealth accumulated by preceding generations. A redistribution of wealth, they proposed, would bolster the sense of community and common citizenship.

Increased wealth or inheritance taxes are likely to be unpopular because they are perceived as an attack on the wealth that we have built up and wish to pass on to our children or others of our choice. But the brilliance of Paine’s 1797 proposal for a cash grant at the age of majority is that it offers a quid-pro-quo for wealth or inheritance taxes at later life.

People will be more ready to accept wealth taxation if they have earlier benefitted from a large cash grant in their youth. Wealth would by recycled to younger generations rather than syphoned away. The more fortunate or successful can be persuaded to give up some of their advantages if they see the benefits for society as a whole.

In the economy, there are many ways of spreading power and influence more broadly. The idea of extending employee shareholding is growing in popularity. This is a flexible strategy for extending ownership of revenue-producing assets in society. In the USA alone, over ten thousand enterprises, employing over ten million workers, are part of employee-ownership, stock bonus, or profit-sharing schemes. Employee ownership can increase incentives, personal identification with the enterprise, and job satisfaction for workers.

As modern capitalist economies become more knowledge-intensive, access to education to develop skills becomes all the more important. Those deprived of such education suffer a degree of social exclusion, and, unless it is addressed, this problem is likely to get worse. Widespread skill-development policies are needed, alongside integrated measures to deal with job displacement and unemployment.

A key challenge for modern capitalist societies, alongside the needs to protect the natural environment and enhance the quality of life, is to retain the dynamic of innovation and investment while ensuring that the rewards of the global system are not returned largely to the richer owners of capital. As Paine put it in 1797:

All accumulation, therefore, of personal property, beyond what a man’s own hands produce, is derived to him by living in society; and he owes on every principle of justice, of gratitude, and of civilization, a part of that accumulation from whence the whole came.

We need to update Paine’s approach to dealing with inequality, to suit modern times.

[1] Data are for 2010 and from the Credit Suisse Research Institute (2012). See also Piketty (2014) for extensive data on inequality.

[2] See Bowles and Gindis (2002) and Credit Suisse Research Institute (2012). See Ackerman and Alstott, (1999) and Atkinson (2015) on policies to reduce inequality.

2016 August 11

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!