By Steve Roth

Like it or not, if countries want to join the “rich-country club,” they need to redistribute wealth. What has not been studied much — at least partially because the data is hard to come by — is the distribution of wealth within countries, and how that relates to economic growth. Is wealth concentration a symptom of what Peter Turchin has called “elite overproduction”?

My devoted readers will undoubtedly remember my 2008 research into rich countries’ wealth inequality and economic growth. (In case you haven’t heard, wealth inequality utterly dwarfs income inequality.) Here’s the bottom line:

Correlations Between Rich Countries’ Wealth Concentration/Inequality and:

| GDP per capita growth | |

| 1970 to 2005 (35 years) | -.67 |

| …from 1975 (30 years) | -.58 |

| …from 1980 (25) | .11 |

| …from 1985 (20) | .22 |

| …from 1990 (15) | .68 |

| …from 1995 (10) | .38 |

| …from 2000 (5) | .44 |

This analysis suggests that in rich countries, greater wealth inequality/concentration goes with faster economic growth over the shorter term, but over the long term it’s associated with much weaker growth. In the long run, trickle-down fails badly. (Viz, the increasing wealth concentration and moribund growth in the U.S. post-Reagan.)

There are numerous problems with this analysis, discussed in that previous post. Not much data was available back then, and the statistical correlation analysis is decidedly sophomoric.

Get Evonomics in your inbox

But now we (finally!) have some more sophisticated work on this correlation from professional economists Sutirtha Bagchia and Jan Svejnar: “Does wealth inequality matter for growth? The effect of billionaire wealth, income distribution, and poverty.” (Gated; a much earlier and different ungated 2013 version is here. A two-page descriptive policy research brief published by the right/libertarian Cato Institute is here.)

Bagchia and Svejnar’s (robust) top-line conclusion:

wealth inequality has a negative relationship with economic growth

(So much for “incentives.”) B&S attempt to distinguish between “politically connected” and unconnected (market-driven) wealth inequality, and conclude that only politically connected wealth inequality — “cronyism” — has a negative association with growth.

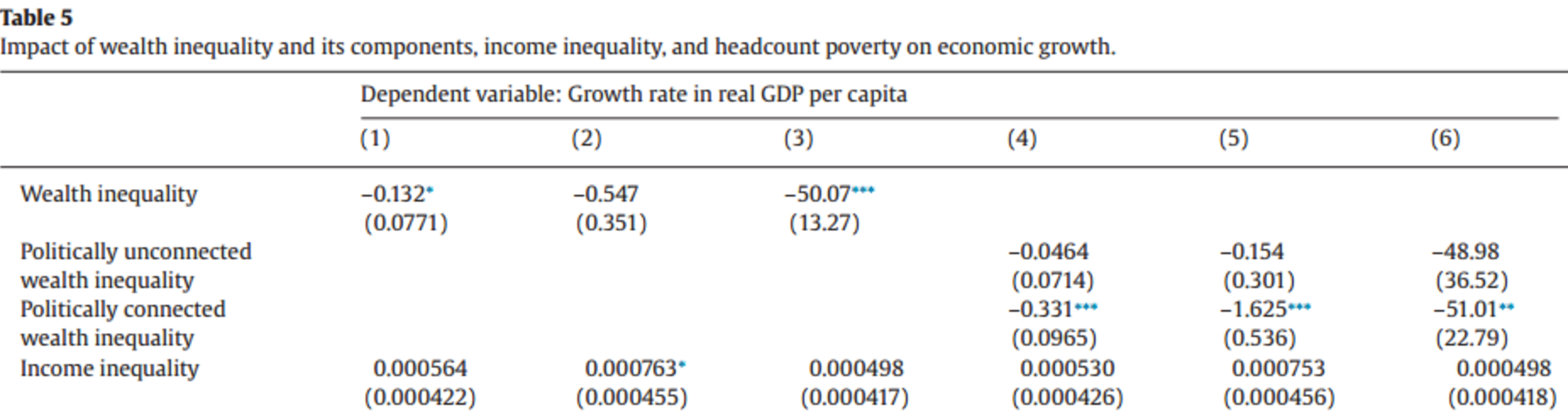

I don’t have access to the latest gated paper, but @NinjaEconomics has posted the key table:

Key points:

• B&S are looking at growth rates over ensuing five years (average annual change in GDP/capita). Interestingly, their negative correlations for this short lag period contradict mine for rich countries, which only showed negative correlation over decades. (It infuriates me, by the way, that every growth-correlation study doesn’t look at multiple time lags, where possible. They should all look like this.)

• Their sample set is a complete grab-bag of countries* — from tiny to large, developed, less-developed, emerging, etc. This gives higher N so greater statistical significance, but makes the true significance of the findings…questionable. We’ve known for decades that predictors and causes of growth are very different in developed and less-developed countries. I’d personally love to see their results for prosperous countries only.

• Such an analysis of similar, prosperous countries would allow them to use the narrower but more reputable Luxembourg Wealth Study data, rather than the data set they constructed based on spottier and far less rigorous Forbes 400 billionaire lists. (Their data and analysis files have not been made available for public vetting.)

• The rather tortuously constructed classification of “politically connected” versus market-driven wealth is, in their own words, “somewhat subjective.” It could not really be otherwise — wildly so, in fact. That they are “fully up-front about how we carry out the classification” does not obviate that reality.

• As Brad DeLong has pointed out, even with that subjectively constructed data set, B&S:

…failed to find a statistically significant difference between the effect on growth of politically-connected wealth inequality and the effect on growth of politically-unconnected wealth inequality. That would be a more accurate description of what the data say.

They trumpet their non-statistically significant finding, in what surely looks like an attempt to downplay their significant main finding.

But perhaps to their chagrin, their main finding holds: wealth concentration, inequality, kills economic growth.

* From the 2013 paper: Australia, Bangladesh, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Costa Rica, Denmark, Dominican Republic, Finland, France, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Ireland, Italy, Japan, Malaysia, Mexico, Netherlands, New Zealand, Norway, Pakistan, Peru, Philippines, Poland, Portugal, Republic of Korea, Singapore, Spain, Sri Lanka, Sweden, Thailand, Trinidad and Tobago, Tunisia, Turkey, United Kingdom, United States, and Venezuela.

14 December 2015

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!