By Guy Rolnik

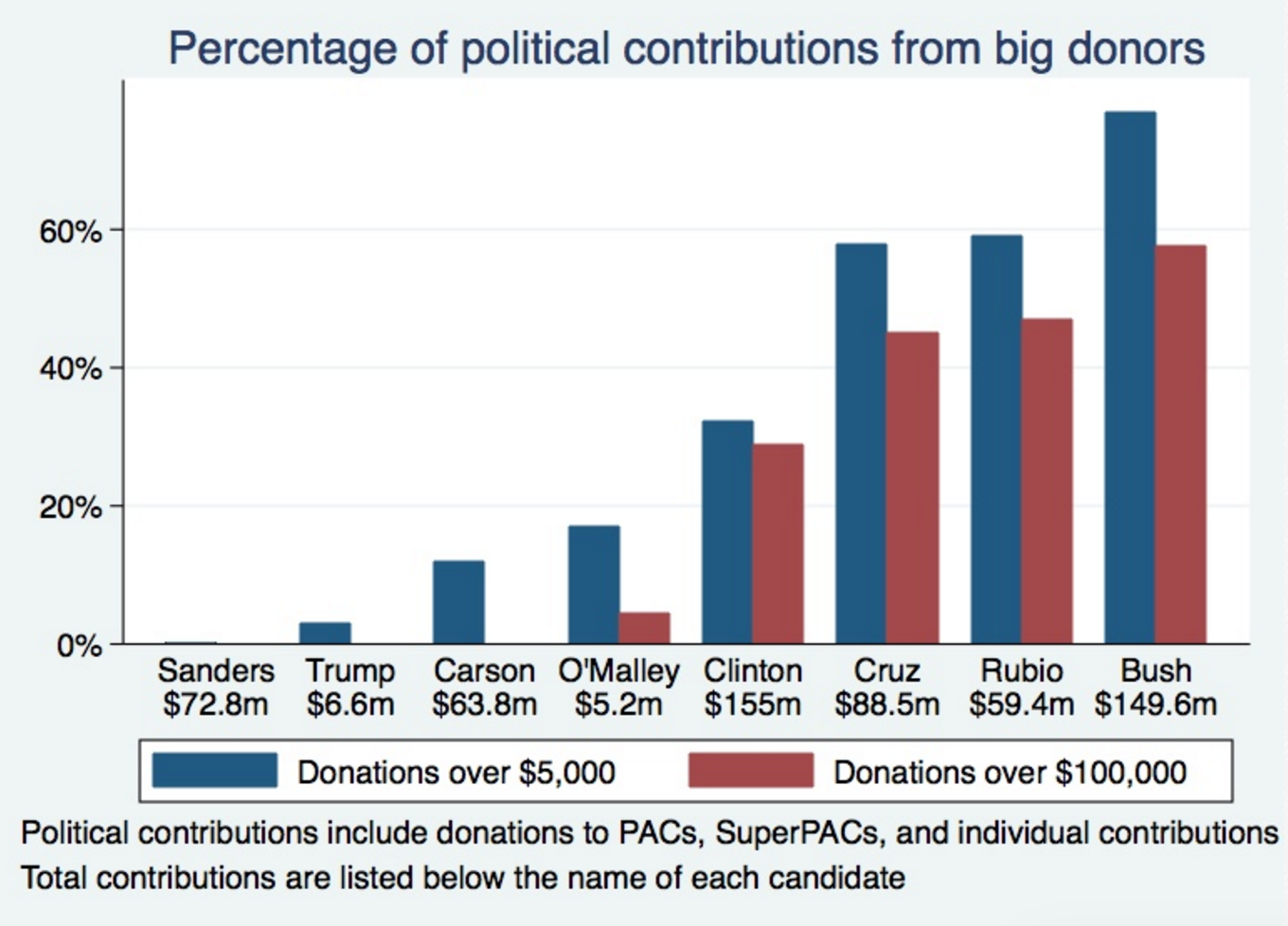

Last month, The George J. Stigler Center at the University of Chicago Booth School of Business launched the Capture Index that looks at the concentration of donations to the presidential candidates. As an economist, I tend to believe in what we call “revealed preferences.” Donations from industries are a better measure of their interest than the candidates promises and rhetoric.

When we look at the numbers, we see very clearly that presidential candidates are not different from most congressmen and women: they are happy to take significant amounts of money from industries whose business models are based on favorable regulation, usually regulation that limits competition and helps the incumbents. It is safe to predict that this concentration of donations from what we call “rent-seeking” industries will only get worse as the presidential race continues—because once the special interest groups identify the winners or the candidates that may be a “threat” to the establishment or the status quo, they will coalesce around a few candidates and inject more and more money into their campaigns.

This is where Bernie Sanders comes into play. You may not subscribe to many of Sanders’s ideas—particularly, those on limiting trade. But one thing is certain: he is really beginning a political and economical revolution. According to our research, Sanders is the only candidate in this race, and actually in the last few decades, who is not taking money from special interest groups. Sanders managed through grassroots movements to raise close to 100 million dollars from the “dispersed public”: that is, taxpayers, consumers, and investors that usually cannot organize and get representation in democracy because they are a large, heterogeneous group that cannot overcome the free rider problem. Sanders is defeating the model that has ruled politics for many years.

The economics of regulatory capture

Professor George Stigler, the Nobel Laureate (1982) who in some ways invented the idea of “regulatory capture,” and Professor Mancur Olson, who developed some of the most important ideas of “public choice,” are not around anymore. If they were alive today, they would probably be surprised to learn that the first politician in recent U.S. history to take their advice seriously and challenge them is a self-described socialist.

Get Evonomics in your inbox

In “The Logic of Collective Action” (1965), Mancur Olson taught us that, over time, most capitalist democracies develop “distributional coalitions,” aka special interest groups, which organize to get the government to provide them with special subsidies, laws, and protection from competition. The dispersed public, be it taxpayers or consumers that are footing the bill, will fail to overcome the free rider problem and lose in the democratic battle with those coalitions. As Olson states in a later book, this is what explains the decline, or sclerosis, of economies.

Stigler, in his “Theory of Economic Regulation” (1972), explained that regulation, which is presumably put in place to protect the public, will eventually be acquired, or “captured,” by the very companies, industries, or their trade unions that are supposed to be “regulated.”

The sprawling Lobbyist industry, revolving doors, money in politics—all those ideas that are today part of the public discourse are tools and symptoms of the ideas Stigler, Olson, and many of their students and colleagues developed in their “public choice” literature.

When you consider how clean, simple, and neat the ideas of Olson and Stigler are—why special interest groups will always carry the day in the battle with the dispersed public—it is easy to develop a cynical and pessimistic view of the world. Only special interest groups will have the incentives to organize, lobby, and win in the democratic process. The public, rationally ignorant and free riding by nature, will always pay the bill.

Olson and Stigler predicted that special interest groups carry the day because they can organize and lobby. They can do this because they can raise a significant amount of resources to push their agenda. These predictions turned out to be very accurate most of the time. The best way to see that is in the vast and growing amount of money being spent by special interest groups on lobbying and campaign contributions, as well as the rents extracted in many industries that get de facto protection from competition. The dispersed public was not relevant to this game.

There are reasons that most of the economic policy debate in the presidential race is framed in the right/left or democrat/republican division. It is easy to put policy, politicians, and economists into familiar “boxes”: conservative and liberal being the obvious ones here. Not only that, but many people also want to be part of a “camp,” because it helps them form an identity and get support and protection for their beliefs and ideology.

Ideology is important, but if we take a look at most industries, markets, and the expenditure of the government, we should ask ourselves whether it is “ideology” or a simpler idea: the rules of the game are determined by the sheer power of the vested interests. Energy, agriculture, healthcare, finance, insurance, defense—there is a reason why they spend billions of dollars on lobbying at the federal, state, and congress levels. They are the people influencing the rules of the game and shaping the discourse and narrative in these industries.

It is time to introduce an old idea that doesn’t get enough time, a perspective that is stripped from this usual discourse and labels. One overarching, important idea, which may be bigger than conservative or liberal economic questions, is that of the capture of democracies and regulations by special interests.

In comes Bernie Sanders. A self-described socialist. He wants to expand government and push the US towards a more Northern European model. He brings into the discourse yet again the debate of small or big government, private or public healthcare and education. But these are old ideas: the real message and idea that Sanders brings is much more interesting and revolutionary.

Until 2016. For the first time in recent history, we have a politician who is able to raise serious, big money—the kind of money that can finance a big campaign—from the dispersed public.

Whoever believes in a market economy assumes that players are “price takers” or “regulation takers”: they cannot influence the prices and the rules of the game. If we want to move into a more competitive market system, we should support the political revolution of Bernie Sanders, specifically the way he raises money. We must acknowledge that as long as it is totally within the norms, values, and beliefs of our society that politicians and regulators can take money from special interest groups, our chances of increasing the legitimacy of market ideas are diminishing.

2016 March 18

Originally published at the Pro Market Blog, “From Mancur Olson to Bernie Sanders”.

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!