In a previous article (“Reforming Economics: The Challenge”), I made the point that organizing the jumbled schools of economic thought into a coherent pluralist curriculum faces both a social and a technical challenge. These two challenges go hand in hand to some degree, since the teaching within any discipline largely reflects the sociology of its practitioners. Social conventions are reflected in teaching, and teaching reinforces those social conventions.

In economics, and the undergraduate courses where the majority of students get their complete economics training, this means uniform domination by the neoclassical approach – mirroring its dominance in mainstream journals and research activities. Even the now decades-old behavioural and experimental school is all but ignored in core economic textbooks, reflecting a contested relationship with the mainstream and an inability to escape the fringes of the discipline.

But I hold an optimistic view. There is a feedback loop that can be broken by offering an attractive teaching alternative that presents an array of approaches and allows for conflicting ideas and methodology to be examined side by side. Such an alternative needs a very broad conceptual map on which each school of thought can be placed, and it needs tools to comprehensively understand and assess the validity of each. Such a map can allow a logical positioning of competing methods across domains of economic interest and can illuminate where and when there might be overlaps or conflicts. Such a map could facilitate a broader language of economics by enabling ideas to be accurately communicated between different schools of thought.

Absent a map, teaching a pluralist curriculum faces huge consistency problems. Others have attempted the relatively straightforward task of incorporating behavioural approaches into core economics courses. They find that conflict between ideas is a teaching obstacle and that there is a tendency to pick winners and losers in such circumstances.

…integrating such insights into microeconomics is not easy. One has to tread a fine line between integrating new and important results without making the standard theory look completely useless to students. This is often advanced as an argument not to integrate newer results at all. I tend to disagree with this view. It supposes that students are unable to hold two opposing thoughts in their head, which I find more than a little patronizing.

Readers may agree that standard microeconomic theory is completely useless, but teaching a pluralist approach does require giving credit to the mainstream where it may be relevant. Finding that relevance needs a map.

Get Evonomics in your inbox

To illustrate, I’ve drawn a mud-map of the economic terrain in a very broad sense. The boxes on the map below represent islands of interest that are related to each other, but are conceptually different domains that cannot be conflated. Money for example, is not a real resource, or a traded widget, as it is almost universally assumed to be in neoclassical models. It is a set of accounts. It has its own domain. Real resources in the economy are also not the set of legal rights over who owns what. These rights are entirely separate. To be clear, money can be thought of as a type of ownership right, so the money and legal rights domains share a common red ‘ownership’, or `power’, environment in my map.Welfare is another domain: distinct but related to real resources, the system of legal rights and the monetary environment. It is this domain that provides a moral foundation for the economy. This domain shares its yellow terrain with the real resources, since can both be considered the area in which mainstream economic theory operates, currently being bridged by the rather inadequate welfare theorems.

Outside these economic islands is the sea of the social and political environment. Any economic domain is enclosed within a social environment, and any analysis of economic problems depends crucially on conditions within this environment. Think of this domain as the evolving norms and institutional structures of society.

Floating in this sea are three tools, or ways to interrogate ideas, that can be carried to each economic island to explore and assess different approaches and to guide learning and discussion.

The first tool is timing. We know the world is dynamic, so asking the question of how timing is dealt with in any economic approach is crucial. History is irrelevant in most mainstream models, while the future is certain (though sometimes risky). Equilibrium arises instantly without adjustment. Asking the question of timing provides clarity about what conditions would need to be met in order for an approach to be valid, and why it might break down. It would expose that a number of diverse theoretical approaches have a common ignorance of time, while others (e.g., evolutionary economics) hold it as their core insight.

The next tool is aggregation. At what level of aggregation is analysis taking place? Is it important that individual and aggregate behaviour may differ? This tool is used to avoid the macro-micro distinction and concentrate on relevant economic questions. After all, a single market is already a macro-economy of buyers and sellers. Firms too are aggregates of individuals, and their existence is worthy of discussion in the legal rights domain. Questions about the how and why of aggregation are some of the least-asked but most important in any domain. How can we aggregate welfare or capital? How are rights divided between and within entities? What level of analysis matters in the monetary system?

Lastly, there is the tool of prediction. This represents the ‘So what?’ question that needs to be asked of any method of analysis on every economic island. Even if an analytical approach seems to adequately address questions of timing and aggregation, it can’t pass scientific muster unless it provides useful predictions. If different schools of thought generate different predictions, it should be possible to trace backwards through the questions of timing and aggregation and (being clear about which domains are being examined and how they are linked) to find the causes of those different predictions.

It might help here to provide an example of how this map can aid the teaching of different ideas in economics and facilitate communication between schools of thought. The map could be used in two ways; either as a way to structure courses, by exploring domains and tools and incorporating different approaches where relevant, or as a way of structuring inquiry into different schools of thought as they arise in the curriculum.

If one were using this map for structured learning about Godley and Lavoie’s monetary circuit models, students would first learn about the institutional setup that produces the monetary domain, including what exactly money is, and how certain relationships to the legal rights and real resources domains are implied. They would then note the way timing is treated and how and why firms, government, banks and other sectors of the economy are aggregated. Finally, they would explore the types of predictions and how they are linked between the money, legal rights, resources and welfare domains.

Later, when learning about mainstream growth theory, it would be clear that this approach resides in the real resources domain where time is condensed to a single point, while its representative agent (or ‘social planner’) deals with aggregation. Predictions of such growth models vary, but most generate only static equilibrium outcomes unless some external shock hits the system. Both the monetary and legal domains are assumed to allow for the outcomes of the models. In practice, the capital terminology used in these models is often confused for capital in the legal rights domain.

We could dig down further into the neoclassical view to explore the still controversial question of what is capital. Here we would see that in standard growth models capital is a collection of physical objects. Yet because we cannot aggregate quantitative measures of the diverse physical objects, but natural and produces, we end up accounting for them by monetary measure of value that are instead comparative measures of value of property rights, which are constructed by our institutions.

By situating these two approaches on the map, and seeing the differences as to aggregation, timing and predictions, we can more clearly see under what conditions they correspond or conflict. For example, investing in more physical capital generates higher growth in both, but only in a monetary circuit model can we potentially say anything about the adjustment processes in the economy. Further, both take the social and political environment as given and only indirectly relate to the welfare domain through an implicit assumptions about the relationship between aggregate resources and aggregate welfare.

It may take a little work, but this type of structured thinking is helpful.

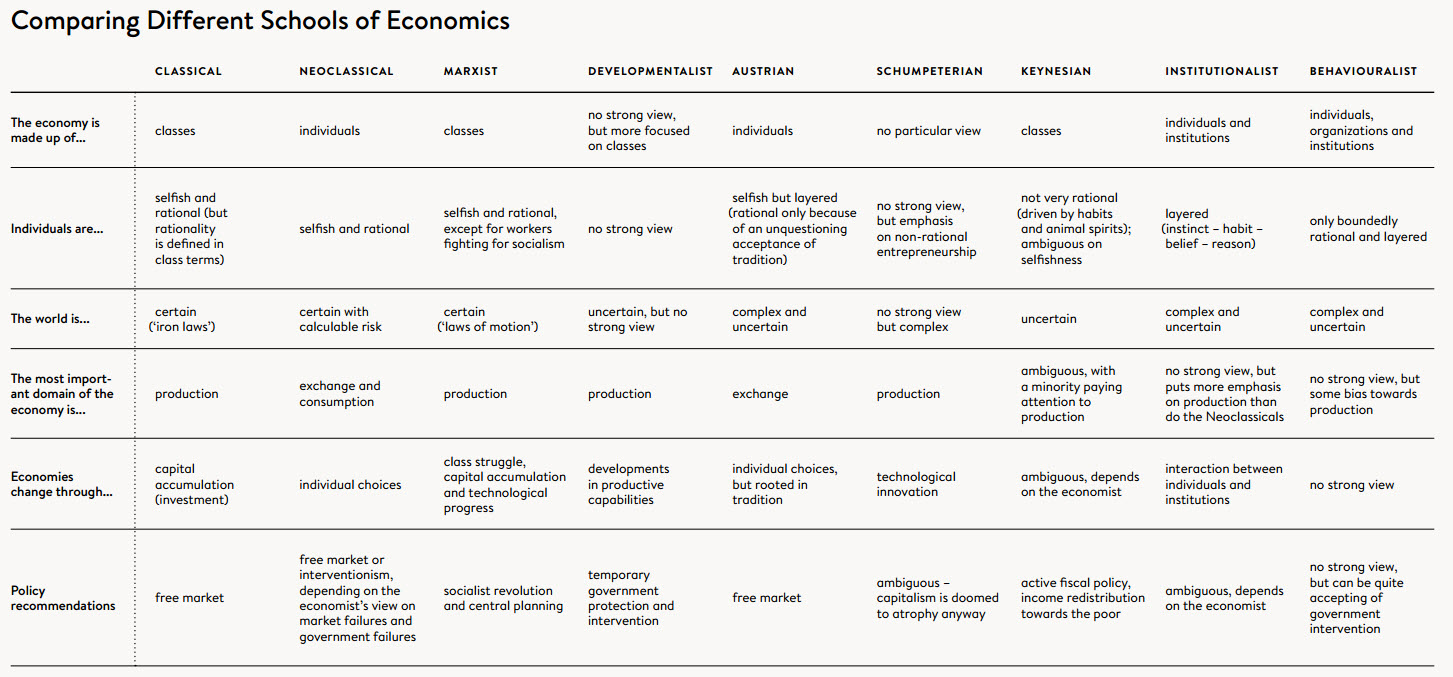

I am not alone in trying to put some structure around the jumble of economic schools. Ha-Joon Chang has mapped schools of economic thought based on particular domains of interest. In his latest book Economics: The User’s Guide there are many of the same general themes of timing (Economies change through…, The world is…) and aggregation (The economy is made up of…), and also the suggestion that different economic approaches focus on certain areas of the economy, such as production or exchange.

If we want a viable pluralist economics curriculum, a way to structure ideas from the diverse schools of thought is absolutely crucial, and I hope this mud-map of economic domains can provide a starting point. New pluralist textbooks and teaching materials based on a structured inquiry can demonstrate how diverse ideas can be brought together, without creating conflict and without transforming the exercise into merely a process of selecting a school of thought that aligns with the student’s existing ideologies. I hope this outcome can emerge from the combined efforts of IDEA Economics, Evonomics, Rethinking Economics and other reformers.

Originally published here.

2016 April 1

Donating = Changing Economics. And Changing the World.

Evonomics is free, it’s a labor of love, and it's an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you're like us — if you think there’s a key leverage point here for making the world a better place — please consider donating. We’ll use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

$3 / month

$7 / month

$10 / month

$25 / month

You can also become a one-time patron with a single donation in any amount.

If you liked this article, you'll also like these other Evonomics articles...

BE INVOLVED

We welcome you to take part in the next evolution of economics. Sign up now to be kept in the loop!